In Canada’s rapidly evolving fintech landscape, Borrowell has emerged as a household name for millions of Canadians seeking to understand and improve their credit health. Founded in 2014, this Toronto-based company has revolutionized how everyday Canadians access their credit information offering free credit scores and personalized financial recommendations at no cost to users.

But here’s the question many Canadians ask: if Borrowell’s services are free, how does the company actually make money?

Understanding Borrowell’s business model offers valuable insights into the modern fintech ecosystem, where consumer value and profitability aren’t mutually exclusive. This blog will explore Borrowell’s core services, dissect its revenue streams, examine its value proposition for both consumers and financial partners, and explain why this model works so well in the Canadian market.

Whether you’re a Borrowell user curious about the platform, an entrepreneur studying successful fintech models, or simply interested in Canada’s financial technology sector, this comprehensive breakdown will give you the full picture.

What Is Borrowell?

Borrowell was founded in 2014 by Andrew Graham and Eva Wong with a clear mission: to make credit information accessible and understandable for all Canadians. At its core, Borrowell is a financial technology company that provides free credit scores, credit monitoring, and personalized financial product recommendations to Canadian consumers.

Target Market

Borrowell specifically serves the Canadian market, focusing on credit-conscious consumers who want to monitor their credit health regularly, understand factors affecting their credit score, find financial products suited to their credit profile, make informed borrowing decisions, and improve their overall financial wellness.

The platform has attracted over 2 million Canadians since its launch, spanning various demographics from young adults building credit for the first time to established borrowers looking to optimise their financial products.

Core Mission

Borrowell’s mission centres on credit transparency and financial empowerment. The company recognises that for too long, Canadians had limited access to their own credit information—often paying fees or only checking their credit when applying for loans. By democratising access to credit scores and education, Borrowell aims to empower Canadians to take control of their financial health, remove barriers to credit information, provide tools and knowledge for better financial decision-making, connect consumers with appropriate financial products, and build a more financially literate Canadian population.

This mission-driven approach has helped Borrowell build significant trust with Canadian consumers while creating a sustainable business model—a win-win that we’ll explore throughout this blog.

Borrowell’s Core Products and Services

Free Credit Score and Report

Borrowell’s flagship offering is free access to your credit score and report—no credit card required, no hidden fees, and no negative impact on your credit.

How It Works

When you sign up for Borrowell, you provide basic personal information and consent to access your credit file. Within minutes, you receive your credit score and a detailed credit report.

Data Source

Borrowell partners with Equifax, one of Canada’s two major credit bureaux (alongside TransUnion). This means the credit score you see on Borrowell is your actual Equifax credit score—the same score many Canadian lenders use when evaluating applications.

Update Frequency

Your credit score updates weekly on Borrowell’s platform, giving you regular insight into how your financial behaviours impact your creditworthiness. This frequent updating is particularly valuable compared to traditional methods where Canadians might only check their credit annually or when applying for major loans.

Personalised Financial Recommendations

Beyond providing credit information, Borrowell acts as a financial marketplace, offering personalised product recommendations based on your credit profile.

Loan Offers

Borrowell shows you personal loans from partner lenders that match your credit profile. These recommendations include estimated approval odds, so you’re not applying blindly and risking unnecessary credit enquiries.

Credit Cards

The platform recommends credit cards suited to your credit score and financial needs—whether you’re looking for rewards cards, low-interest options, or cards to help build credit.

Mortgages and Other Financial Products

Borrowell has expanded to include mortgage pre-approvals, car loans, and other financial products, all personalised to your situation. This comprehensive approach makes Borrowell a one-stop shop for Canadians exploring various financial options.

Credit Education Tools

Borrowell doesn’t just show you numbers—it helps you understand them and improve over time.

Credit Monitoring

The platform monitors your Equifax credit file for changes, helping you spot potential errors or fraudulent activity quickly.

Financial Insights and Tips

Borrowell provides educational content explaining credit score factors, how different actions affect your credit, and strategies for improvement. These insights are personalised based on your specific credit profile.

Alerts and Score Tracking

Users receive notifications when their credit score changes, when new accounts appear on their report, or when hard enquiries are made. This real-time awareness helps Canadians stay on top of their credit health and catch issues early.

The credit score simulator is particularly popular—it lets you model how different financial decisions (like paying off a credit card or opening a new account) might impact your score before you take action.

Borrowell Business Model Overview

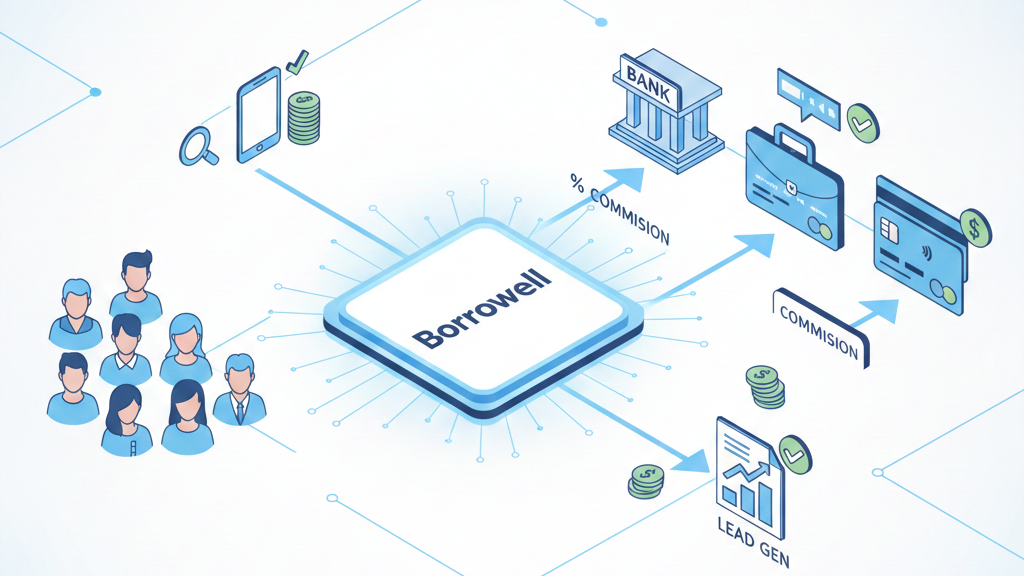

At its heart, Borrowell operates a two-sided marketplace model—a platform that creates value by connecting two distinct groups: Canadian consumers seeking financial products and financial institutions seeking qualified customers.

Platform/Marketplace Model

In this model, Borrowell doesn’t lend money or issue credit cards itself. Instead, it acts as an intelligent intermediary, matching consumers with appropriate financial products from partner lenders and credit card issuers. Think of it like a dating app, but for financial products—Borrowell uses data and algorithms to create compatible matches between consumers and lenders.

Role as an Intermediary

Borrowell’s position between consumers and financial institutions is strategic. On the consumer side, Borrowell provides free tools, education, and personalised recommendations that help Canadians make better financial decisions. On the lender side, Borrowell delivers pre-qualified, high-intent leads—consumers who have actively expressed interest in specific financial products and whose credit profiles match the lender’s criteria.

This intermediary role is valuable because both sides benefit from the matching process. Consumers discover products they’re likely to qualify for (reducing rejection and wasted applications), while lenders gain access to qualified prospects without spending heavily on broad marketing campaigns.

How Value Is Created for Both Sides

Value creation for consumers includes free access to credit information (normally costs money), personalised recommendations (saves time researching), better approval odds (pre-qualified matching), financial education (improves decision-making), and no impact on credit score when browsing (safe exploration).

Value creation for financial partners includes access to engaged, credit-aware consumers, pre-screened leads matching their credit criteria, lower customer acquisition costs compared to traditional marketing, performance-based pricing (only pay for results), and consumer insights and data-driven targeting.

This mutual value creation is what makes the marketplace model sustainable. Borrowell doesn’t need to charge consumers because it creates enough value for financial partners that they’re willing to pay for access to Borrowell’s user base.

How Borrowell Makes Money (Revenue Streams)

Now we get to the core question: How does Borrowell generate revenue while offering free services to consumers?

Referral Fees

This is Borrowell’s primary revenue stream. When a Borrowell user clicks on a recommended financial product, applies, and gets approved, Borrowell receives a commission or referral fee from the financial institution.

Commission Structure

The commission model typically works in one of two ways. Pay-per-approval means Borrowell receives a fee when a user is approved for a financial product, regardless of whether they ultimately accept the offer. Pay-per-funded-loan means for loan products, Borrowell may receive payment only when a loan is actually funded—meaning the borrower has accepted the terms and received the money.

The commission amounts vary depending on the product type. Personal loans typically offer higher commissions (often ranging from $50 to $200 or more per funded loan), while credit cards usually pay smaller commissions per approval (ranging from $20 to $100 depending on the card type). Mortgages, given their size and value, can generate significant referral fees, sometimes several hundred dollars per successful mortgage application.

This performance-based model aligns Borrowell’s interests with both parties—Borrowell only makes money when it successfully connects consumers with products they actually want and qualify for.

Lead Generation

Beyond direct referrals, Borrowell generates revenue through sophisticated lead generation and matching.

Matching Qualified Users with Lenders

Borrowell’s platform collects substantial data about user credit profiles, financial goals, and product preferences. This information allows Borrowell to identify high-quality leads for specific lenders. For example, a lender specialising in debt consolidation loans for mid-range credit scores would pay for access to Borrowell users who match that exact profile.

Data-Driven Targeting

Using advanced analytics, Borrowell can predict which users are most likely to be interested in specific products and most likely to be approved. This targeting capability makes Borrowell’s leads more valuable than generic advertising leads because they’re pre-qualified and have demonstrated intent.

Financial institutions value these targeted leads because they convert at much higher rates than cold prospects, making the cost per acquisition significantly lower than traditional marketing channels.

Partner Promotions

Borrowell also generates revenue through promotional partnerships with financial institutions.

Sponsored Financial Products

Some lenders pay to have their products featured more prominently on Borrowell’s platform. These sponsored placements appear alongside organically recommended products, clearly labelled to maintain transparency with users.

Featured Listings

Financial institutions may pay for enhanced visibility within specific product categories. For example, a new entrant to the Canadian market might pay for featured placement to build brand awareness among Borrowell’s user base.

It’s important to note that Borrowell maintains editorial integrity—sponsored products must still be relevant to the user’s credit profile. The platform doesn’t recommend products users are unlikely to qualify for, even if those products offer higher commissions.

Value Proposition

Value for Users

Borrowell’s value proposition for Canadian consumers is compelling and multifaceted.

Free Access to Credit Scores

In Canada, accessing your credit score traditionally required paying fees to credit bureaux or signing up for paid monitoring services. Borrowell eliminated this barrier, providing free weekly access to your Equifax credit score and report. This democratisation of credit information empowers millions of Canadians who previously couldn’t or wouldn’t pay for this data.

Better Financial Decision-Making

By providing not just credit scores but also educational content, personalized recommendations, and decision-making tools, Borrowell helps Canadians make smarter financial choices. Users can see which products they’re likely to qualify for before applying, reducing rejections and unnecessary credit inquiries.

The platform’s transparency about approval odds is particularly valuable—instead of applying for multiple credit cards and getting rejected (which harms your credit), you can focus on products where you have a high likelihood of approval.

No Impact on Credit Score

One of Borrowell’s most significant advantages is that checking your credit score through the platform doesn’t impact your credit. This is because Borrowell performs a “soft” credit check rather than a “hard” inquiry. You can check your score as often as you like without any negative consequences—something that wasn’t possible before digital credit platforms.

Value for Financial Partners

Borrowell’s value proposition for lenders and financial institutions is equally strong.

High-Intent, Pre-Qualified Leads

Unlike traditional advertising that casts a wide net, Borrowell delivers consumers who have actively engaged with their credit information and expressed interest in specific financial products. These aren’t passive viewers of an advertisement—they’re educated, credit-aware consumers actively seeking financial solutions.

Moreover, Borrowell’s matching algorithm ensures that leads are pre-qualified based on credit criteria, meaning approval rates are significantly higher than industry averages.

Lower Customer Acquisition Cost

Customer acquisition is one of the biggest expenses for financial institutions. Traditional marketing channels—television ads, direct mail, digital advertising—are expensive and often inefficient. Borrowell’s performance-based model means lenders only pay when they acquire actual customers, dramatically improving their return on marketing investment.

For many lenders, the cost per acquisition through Borrowell is substantially lower than their average across all channels, making it an attractive addition to their marketing mix.

Access to Consumer Insights

By partnering with Borrowell, financial institutions gain valuable insights into consumer behaviour, preferences, and credit profiles. This data helps them refine their product offerings, pricing strategies, and targeting criteria.

Borrowell’s analytics can show lenders which segments of consumers are most interested in their products, what features drive application decisions, and how their offerings compare to competitors in the eyes of real consumers.

Key Resources and Technology

Borrowell’s business model depends on several critical resources and technological capabilities.

Credit Bureau Partnerships

Borrowell’s partnership with Equifax is fundamental to its entire operation. This relationship allows Borrowell to access consumer credit files and provide real-time credit scores and reports to users. Maintaining this partnership requires meeting strict security, compliance, and data handling standards.

The relationship also provides Borrowell with credibility—users trust that they’re seeing their actual Equifax score, not some proprietary or less meaningful scoring model.

Data Analytics and AI-Driven Recommendations

Behind Borrowell’s simple user interface lies sophisticated data science and machine learning technology. The platform analyses thousands of data points to generate personalised product recommendations, predict approval likelihood, and match consumers with appropriate lenders.

This recommendation engine is constantly learning and improving, incorporating feedback from successful and unsuccessful applications to refine its matching accuracy. The better these recommendations become, the more value Borrowell creates for both consumers and lenders, strengthening its competitive position.

Secure Digital Platform

Security and reliability are non-negotiable in financial technology. Borrowell invests heavily in cybersecurity infrastructure, encryption, secure data storage, and compliance systems to protect sensitive consumer financial information.

The platform must handle millions of credit file accesses, thousands of daily applications, and countless user interactions all while maintaining bank-level security and meeting stringent Canadian privacy regulations.

Borrowell’s technology stack also includes a user-friendly web and mobile interface, integration systems to connect with multiple financial institution partners, automated application routing and tracking, and communication systems for alerts and notifications.

Customer Acquisition Strategy

Borrowell has grown to over 2 million Canadian users through a multi-pronged customer acquisition strategy.

Digital Marketing and SEO

Borrowell invests significantly in digital marketing, particularly search engine optimisation. When Canadians search for terms like “free credit score Canada,” “check my credit score,” or “improve credit rating,” Borrowell consistently appears in top search results.

The company also maintains a robust content marketing strategy, publishing educational articles, guides, and tools that attract organic traffic and establish Borrowell as a trusted authority on credit and personal finance in Canada.

Paid advertising across Google, social media platforms, and display networks helps Borrowell reach Canadians actively researching financial products or seeking credit information.

Referral and Word-of-Mouth Growth

Borrowell’s referral programme incentivises existing users to invite friends and family. When someone signs up through a referral link, both parties receive rewards, creating a viral growth loop.

Word-of-mouth has been particularly powerful for Borrowell because the service genuinely provides value. Satisfied users naturally recommend the platform to others, especially since there’s no cost or risk involved.

Online reviews, social media mentions, and personal recommendations have been crucial in building Borrowell’s user base, particularly among younger Canadians who trust peer recommendations more than traditional advertising.

Trust-Building Through Free Services

Perhaps Borrowell’s most effective acquisition strategy is its core offering itself. By providing genuinely valuable services for free with no strings attached, Borrowell builds trust and removes all barriers to sign-up.

New users can create an account, access their credit score, and explore the platform without providing payment information or making any commitments. This frictionless on-boarding significantly improves conversion rates compared to services requiring upfront payment or credit card details.

Once users experience the value of free credit monitoring and education, they become engaged platform users who regularly return to check their scores, read content, and eventually explore financial product recommendations—at which point Borrowell can monetise through referrals.

Competitive Advantage

Borrowell has established several competitive advantages in the Canadian fintech market.

Free Credit Score in Canada

Borrowell was a pioneer in offering free credit scores to Canadians. While this is no longer unique, Borrowell’s early-mover advantage helped it build brand recognition and capture significant market share before competitors entered the space.

The company’s commitment to keeping this service truly free—no hidden fees, no required credit card, no paid upsells—continues to differentiate it from some competitors who use “free” as a marketing hook but push users toward paid subscriptions.

Strong Brand Trust

In financial services, trust is everything. Borrowell has cultivated a reputation for transparency, security, and genuinely putting consumers first. This trust manifests in several ways including positive user reviews and testimonials, high Net Promoter Scores, media coverage and endorsements, and longevity in the market (operating successfully since 2014).

Canadian consumers feel comfortable sharing sensitive financial information with Borrowell, confident that their data will be protected and used responsibly—a critical factor in acquiring and retaining users.

Personalised Recommendations

Borrowell’s recommendation engine is sophisticated and genuinely helpful. Unlike generic comparison sites that show all available products, Borrowell uses your actual credit profile to suggest products you’re likely to qualify for.

This personalisation saves users time, reduces rejection, and increases satisfaction. The more users interact with Borrowell and provide feedback, the better these recommendations become, creating a virtuous cycle of improvement.

Simple User Experience

Borrowell’s interface is clean, intuitive, and accessible to Canadians regardless of their financial literacy level. The platform presents complex credit information in an understandable format, with visual aids, plain language explanations, and clear action steps.

This simplicity extends to the entire user journey—from sign-up to credit monitoring to applying for products. Many competitors offer similar services but with more cluttered interfaces, confusing navigation, or overwhelming amounts of information.

Competitors and Market Position

Borrowell operates in an increasingly competitive Canadian fintech landscape.

Comparison with Credit Karma and Other Fintech Platforms

Credit Karma entered the Canadian market and quickly became Borrowell’s primary competitor, offering a similar free credit score model. However, there are notable differences. Credit Karma partners with TransUnion (the other major Canadian credit bureau), while Borrowell uses Equifax, meaning they’re showing users different credit scores. Some Canadians use both platforms to get a complete picture from both bureaux.

Other competitors in the Canadian market include Mogo, which offers credit score monitoring alongside other financial services like mortgages and cryptocurrency, Scotiabank’s CreditView, where the bank provides free credit scores to customers (but only bank customers, limiting reach), and various comparison websites and financial marketplaces, though most don’t offer free credit monitoring.

Differentiation Factors

Borrowell differentiates itself through its focus on education and empowerment rather than just product sales, a clean, user-friendly platform without excessive advertising clutter, weekly credit score updates (more frequent than many competitors), comprehensive credit monitoring with alerts and insights, and a strong Canadian brand identity and understanding of the Canadian market.

Borrowell’s positioning as a trusted financial advisor rather than just a product marketplace helps it maintain user loyalty even as competition intensifies. Users return regularly to check their scores and read content, not just when they need a loan, creating ongoing engagement that competitors struggle to replicate.

Risks and Challenges

Despite its success, Borrowell faces several risks and challenges.

Regulatory Compliance

Financial services are heavily regulated in Canada, and Borrowell must navigate a complex regulatory landscape including privacy laws under PIPEDA (Personal Information Protection and Electronic Documents Act), consumer protection regulations, financial services licensing requirements, and credit reporting regulations.

Regulatory changes could impact Borrowell’s business model, data handling practices, or operational costs. The company must maintain robust compliance programmes and stay ahead of evolving regulations.

Data Privacy and Security

Borrowell handles extremely sensitive personal and financial information for millions of Canadians. A single data breach could be catastrophic, destroying user trust, triggering regulatory penalties, generating lawsuits, and causing massive reputational damage.

The company must continuously invest in cybersecurity, stay ahead of evolving threats, and maintain the highest standards of data protection. As cyber threats become more sophisticated, the cost and complexity of maintaining security increase.

Dependence on Partner Financial Institutions

Borrowell’s revenue depends entirely on financial institutions paying for referrals and leads. Several dependencies create risk including commission rate changes (partners could reduce what they pay per referral), partner departures (major lenders leaving the platform would reduce product options), increased competition (more platforms competing for the same lender partnerships), and economic downturns (lenders might reduce marketing spend during recessions).

Borrowell must continuously prove its value to financial partners and maintain strong relationships to ensure sustainable revenue streams.

Additionally, Borrowell’s reliance on Equifax means that any disruption to that partnership would be severely damaging. The company has limited negotiating power given Equifax’s oligopolistic position in the credit bureau market.

Future Growth Opportunities

Looking ahead, Borrowell has several avenues for growth and expansion.

Expanded Financial Products

Borrowell could broaden its marketplace to include insurance products (home, auto, life insurance comparisons and recommendations), investment products (RRSPs, TFSAs, robo-advisors), banking services (high-interest savings accounts, chequing accounts), and utility services (mobile plans, internet, potentially energy in deregulated provinces).

Each new product category represents additional revenue potential while increasing the platform’s value to users by becoming a comprehensive financial hub.

Deeper Personalisation

Advancements in AI and machine learning could enable even more sophisticated personalisation including predictive insights (alerting users before their score is likely to drop), financial goal tracking (helping users work toward specific objectives like buying a home), automated financial planning (providing holistic financial advice beyond just credit), and behavioural nudges (encouraging positive financial behaviours at optimal times).

The more personalised and proactive Borrowell becomes, the more indispensable it is to users’ financial lives.

Potential B2B or Subscription Offerings

Borrowell could explore new revenue streams beyond the consumer marketplace model including premium subscriptions (advanced features, more frequent updates, premium support for power users), B2B services (credit education and monitoring for employers to offer employees), white-label solutions (providing Borrowell’s technology to other financial institutions), and data and insights products (selling aggregated, anonymised consumer financial data and trends to researchers, policymakers, or businesses).

These additional revenue streams would reduce dependence on referral fees and diversify the business model.

Conclusion

Borrowell’s business model is a masterclass in creating value for multiple stakeholders simultaneously. By offering genuinely free and useful services to Canadian consumers, Borrowell has built a massive, engaged user base. By delivering high-quality, pre-qualified leads to financial institutions, it has created a sustainable revenue model that doesn’t require charging consumers.

The marketplace model works particularly well in Canada’s fintech ecosystem for several reasons. Canada’s concentrated financial services market (dominated by a few major banks) created opportunities for new entrants to serve consumers differently. Limited access to free credit information before Borrowell created pent-up demand. High financial literacy among Canadians made credit-aware consumers receptive to Borrowell’s educational approach. And a robust regulatory framework provided clear rules for fintech companies to operate within.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.