Short answer: Walmart makes money by selling everyday products at very low margins but extremely high volume, powered by scale, supply chain efficiency, private labels, and a growing eCommerce and advertising ecosystem.

Why this matters: Walmart isn’t just a retailer. It’s a logistics, pricing, data, and ecosystem business built to win on cost and convenience.

What Is Walmart?

Walmart is the world’s largest retailer by revenue, operating over 10,500 stores across 19 countries and serving approximately 230 million customers weekly. Founded by Sam Walton in 1962 in Rogers, Arkansas, the company has grown from a single discount store into a $648 billion retail giant.

The company operates through three primary segments:

Walmart U.S. — The core domestic retail operation with supercenters, discount stores, and neighborhood markets. This segment generates the majority of Walmart’s revenue.

Walmart International — Operations in countries like Mexico, Canada, China, and the UK, adapted to local market preferences while maintaining the core low-price value proposition.

Sam’s Club — A membership-only warehouse club competing directly with Costco, serving both individual consumers and small businesses with bulk purchasing options.

What makes Walmart’s model nearly impossible to replicate is the combination of scale, infrastructure investment, and decades of supply chain optimization. A new competitor can’t simply copy the strategy they’d need billions in capital, thousands of store locations, and supplier relationships built over 60+ years.

Walmart’s Core Value Proposition

For Customers

Everyday Low Pricing (EDLP): Unlike competitors who rely on promotional sales cycles, Walmart maintains consistently low prices. This builds trust and eliminates the need for customers to wait for sales or clip coupons.

One-Stop Shopping: From groceries and pharmacy to electronics and automotive services, Walmart consolidates multiple errands into a single trip. The average supercenter carries 120,000+ items.

Wide Product Assortment: Whether you need organic produce, budget electronics, or prescription medication, Walmart stocks products across every price point and category.

Omnichannel Convenience: Customers can shop in-store, online for home delivery, or use curbside pickup—often receiving orders the same day through Walmart’s local fulfilment network.

For Sellers & Brands

Massive Customer Reach: Walmart provides access to millions of customers without requiring sellers to build their own customer acquisition engine.

High-Volume Sales Opportunity: A product that gains shelf space at Walmart can achieve sales volume impossible through most other channels, though often at lower margins.

Logistics Support: Walmart offers fulfilment services that handle warehousing, shipping, and returns—critical for smaller brands lacking infrastructure.

Advertising Visibility: Through Walmart Connect, brands can buy sponsored product placements and reach shoppers with high purchase intent at the exact moment they’re deciding what to buy.

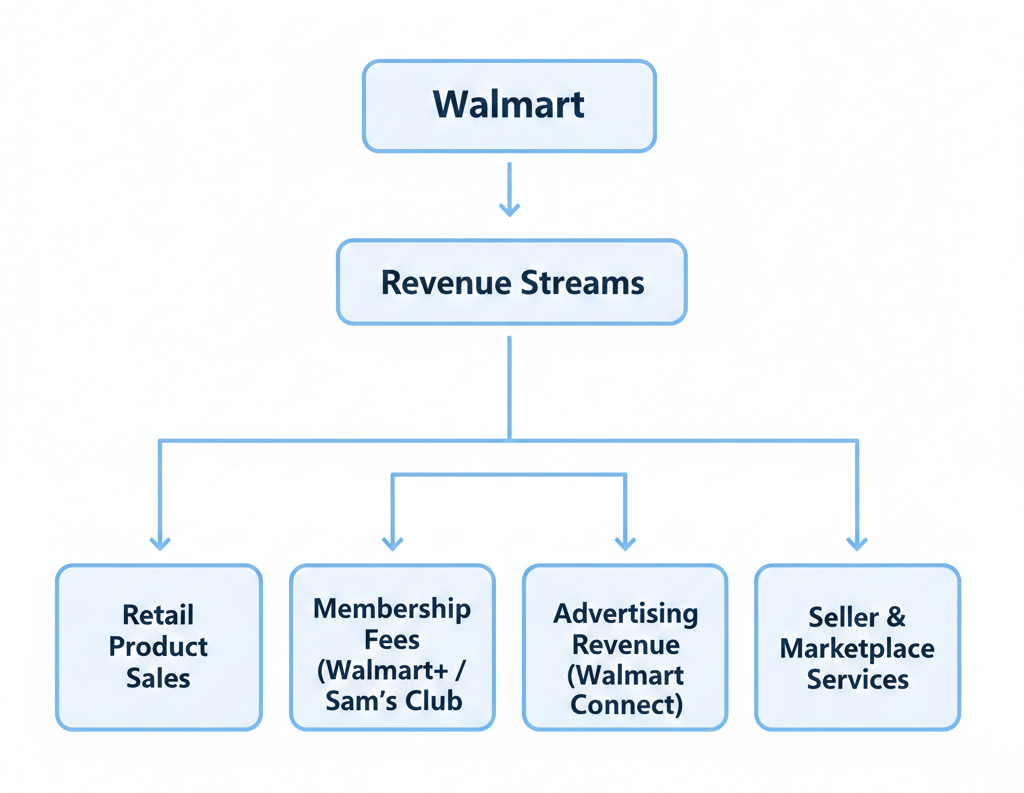

How Walmart Makes Money (Revenue Streams)

Retail Sales (Primary Revenue)

The foundation of Walmart’s business remains straightforward: buy products from suppliers and sell them to customers at a markup. However, the scale transforms this simple model into something extraordinary.

In-store sales still represent the majority of revenue. Walmart’s physical locations serve as distribution hubs that double as customer-facing storefronts, creating efficiency most pure-play eCommerce companies can’t match.

Online product sales have grown dramatically, especially post-pandemic. Walmart’s eCommerce revenue now exceeds $80 billion annually, with grocery delivery and pickup driving much of this growth.

Grocery dominance is Walmart’s secret weapon. Groceries drive frequent visits (2-3 times per week vs. monthly for general merchandise), creating more opportunities to sell higher-margin items. Walmart is the largest grocery retailer in the United States.

Private Labels

Walmart’s private label brands generate significantly higher margins than national brands while maintaining lower prices for customers—a rare win-win.

Great Value — The flagship private label spanning thousands of grocery and household products, often priced 20-40% below name brands.

Equate — Health and beauty products that compete directly with brands like Neutrogena and Advil at fraction of the cost.

Sam’s Choice — Premium private label targeting customers willing to pay slightly more for quality while still saving versus national premium brands.

These brands represent over $30 billion in annual sales. The margin advantage comes from eliminating the brand tax—Walmart doesn’t pay for national advertising, celebrity endorsements, or brand licensing fees.

Membership Revenue (Sam’s Club & Walmart+)

Sam’s Club memberships cost $50-110 annually and create predictable recurring revenue while locking customers into the ecosystem. Members shop more frequently and spend more per visit to justify their membership fee.

Walmart+ ($98/year) launched in 2020 as a direct Amazon Prime competitor, offering free delivery, fuel discounts, and early access to deals. While membership numbers aren’t disclosed, this creates a growing subscription revenue stream with 80%+ gross margins.

The beauty of membership models: they convert transactional customers into committed ones. A customer who pays $98 upfront is psychologically motivated to shop at Walmart to recoup that investment.

Advertising Revenue (Walmart Connect)

Walmart Connect is one of the fastest-growing parts of the business, with advertising revenue exceeding $3.4 billion and growing 26% year-over-year.

Sponsored product listings allow brands to pay for prominent placement in search results and category pages—similar to Google Ads but with direct purchase intent.

Display advertising appears throughout Walmart’s digital properties, in-store screens, and even on Walmart’s growing streaming service, Roku partnership.

First-party data advantage: Unlike Facebook or Google, Walmart knows exactly what customers buy, not just what they click. This closed-loop attribution (seeing whether an ad directly led to a purchase) makes Walmart’s ad platform incredibly valuable to brands.

As retail margins compress, advertising represents a high-margin growth engine. Every dollar spent on Walmart Connect ads flows almost directly to operating income.

Marketplace & Seller Services

Walmart’s third-party marketplace now includes over 150,000 sellers, expanding product selection without inventory risk.

Seller commissions (typically 8-15% of sale price) generate revenue from products Walmart never touches.

Fulfilment services allow sellers to leverage Walmart’s logistics network for a fee, similar to Amazon FBA (Fulfillment by Amazon).

Value-added services include advertising tools, analytics dashboards, and premium placement options that sellers pay for to compete more effectively on the platform.

This creates a flywheel: more sellers mean more product selection, which attracts more customers, which attracts more sellers.

Walmart’s Cost Structure (Why Low Prices Still Work)

How does Walmart profit on razor-thin margins? The answer is systems, scale, and speed.

Massive supply chain scale: Walmart’s purchasing power allows it to negotiate prices suppliers can’t offer smaller retailers. When you order 100,000 units instead of 1,000, unit economics transform.

Direct supplier relationships: Walmart often bypasses distributors and works directly with manufacturers, eliminating middleman costs. For some products, Walmart even dictates packaging specifications to optimize shipping density.

High inventory turnover: Walmart turns inventory over 8-9 times per year versus 4-5 times for typical retailers. Products spend less time sitting in warehouses consuming capital and space.

Data-driven pricing: Walmart uses algorithms to optimize pricing across 120,000+ products in real-time, responding to local competition, demand patterns, and cost fluctuations.

Thin margins + volume economics: Net profit margins hover around 2.4%—seemingly terrible until you realize 2.4% of $648 billion is $15.5 billion in annual profit. The low margins create a barrier to entry; competitors operating at 5-6% margins can’t compete on price without going unprofitable.

Walmart Business Model Canvas

Customer Segments

Price-sensitive consumers: Families stretching budgets, retirees on fixed incomes, and anyone prioritizing value over brand prestige.

Mass market buyers: The “average American household” shopping for everyday needs across all income levels.

Small businesses: Sam’s Club serves restaurants, offices, and small retailers who buy in bulk for resale or operational use.

Third-party sellers: Entrepreneurs and brands using Walmart’s marketplace as a sales channel.

Value Propositions

Everyday low prices: The core promise—consistent savings without games or gimmicks.

Wide product selection: Everything from fresh produce to furniture under one roof (or website).

Physical + digital convenience: Shop however you want—in person, online, pickup, or delivery.

Fast local fulfillment: Same-day or next-day availability through the store network acting as micro-fulfillment centers.

Channels

Physical retail stores: 4,700+ U.S. locations serving as showrooms, fulfillment centers, and return hubs.

Walmart website: A comprehensive eCommerce platform rivaling Amazon in grocery and essentials.

Mobile apps: Over 160 million app downloads enabling shopping, list-making, and in-store navigation.

Marketplace platform: Third-party seller integration expanding selection exponentially.

Customer Relationships

Self-service shopping: Minimal hand-holding; customers find products independently using signage and apps.

Membership programs: Sam’s Club and Walmart+ create ongoing relationships beyond individual transactions.

Loyalty through pricing: Customers return because they trust they’re getting the best deal, not because of points programs.

Data-driven personalization: Recommendations and offers based on purchase history (though less sophisticated than Amazon’s).

Revenue Streams

Product sales: 90%+ of revenue from selling merchandise.

Membership subscriptions: Growing recurring revenue from Walmart+ and Sam’s Club.

Advertising revenue: Fastest-growing segment as brands compete for customer attention.

Seller and logistics fees: Marketplace commissions and fulfillment services.

Key Resources

Physical stores: Real estate footprint worth tens of billions, impossible to replicate quickly.

Distribution centers: Over 150 fulfillment centers strategically located to serve stores within one day’s drive.

Supply chain infrastructure: Proprietary logistics systems, transportation fleet, and vendor relationships.

First-party customer data: Transaction history from 230 million weekly shoppers informs pricing, assortment, and advertising.

Private label brands: Owned intellectual property generating higher margins.

Key Activities

Procurement and sourcing: Negotiating with thousands of suppliers globally to secure the lowest costs.

Logistics and inventory management: Moving products from manufacturers to stores with minimal waste and maximum speed.

Price optimization: Continuously adjusting prices to remain competitive while protecting margins.

Store and eCommerce operations: Running thousands of locations and a sophisticated digital platform simultaneously.

Key Partners

Global suppliers: Companies like Procter & Gamble, Unilever, and thousands of manufacturers.

Logistics partners: Third-party carriers supplementing Walmart’s own fleet.

Marketplace sellers: Expanding product selection without capital investment.

Technology providers: Companies providing cloud infrastructure, analytics, and automation tools.

Cost Structure

Procurement costs: Largest expense—paying suppliers for inventory.

Store operations: Real estate, utilities, maintenance across thousands of locations.

Logistics and warehousing: Transportation, distribution centers, fuel costs.

Technology and data infrastructure: IT systems, eCommerce platform, cybersecurity.

Employee wages: Walmart employs 2.1 million people in the U.S. alone, making labor a significant cost category.

Walmart’s Supply Chain Advantage (The Real Moat)

Walmart’s competitive advantage isn’t pricing strategy—it’s the operational excellence that makes low pricing sustainable.

Cross-docking logistics model: Products arrive at distribution centers and are immediately sorted and reloaded onto trucks headed to stores, often without ever entering warehouse storage. This reduces handling costs and speeds delivery.

Regional fulfillment centers: Strategically positioned to serve clusters of stores within 24 hours, minimizing transportation costs while maintaining inventory freshness.

Store-as-warehouse strategy: Rather than building separate eCommerce fulfillment centers like Amazon, Walmart uses existing stores as local distribution hubs. Employees pick online orders from store shelves, then hand them to customers at pickup or pass them to delivery drivers.

Last-mile delivery optimization: Partnerships with services like DoorDash, Uber, and Instacart supplement Walmart’s own delivery network, providing flexibility without fixed costs.

Cost leadership through operational discipline: Every process is measured, optimized, and standardized. Walmart famously tracks metrics like “cost to serve per case” and challenges every expense that doesn’t directly create customer value.

This isn’t glamorous, but it’s brutally effective. While competitors focus on marketing and branding, Walmart obsesses over removing pennies from the cost of moving a can of soup from factory to customer.

Walmart vs Amazon: Business Model Difference

Both are retail giants, but their strategies diverge significantly.

Walmart: Store-led + logistics efficiency

- Started with physical retail, added digital

- Strengths in grocery and immediate needs

- Leverages stores as fulfillment infrastructure

- Lower technology intensity, higher capital intensity

- Wins on local convenience and fresh products

Amazon: Platform-led + tech dominance

- Started with eCommerce, now expanding to physical

- Strengths in selection depth and delivery speed

- Purpose-built fulfillment centers optimized for shipping

- Higher technology intensity (AWS, algorithms, automation)

- Wins on non-perishable goods and Prime ecosystem

Walmart wins in groceries and local fulfillment: You can’t ship milk cost-effectively from a centralized warehouse. Walmart’s 4,700 stores are within 10 miles of 90% of Americans unbeatable for same-day grocery delivery.

Amazon wins in selection depth and cloud economics: Amazon stocks millions more items and subsidizes retail losses with AWS profits. Their technology infrastructure (recommendation engines, cloud computing, logistics automation) is years ahead.

The competition is pushing both companies toward convergence. Amazon bought Whole Foods and is opening physical stores. Walmart invested billions in eCommerce and cloud partnerships. The future likely involves customers using both for different needs.

Why Walmart’s Business Model Still Works

In an era of direct-to-consumer brands, specialty retailers, and eCommerce disruption, Walmart’s 1960s-era model not only survives—it thrives. Why?

Inflation-resilient pricing: When costs rise, budget-conscious consumers trade down from Target, specialty stores, and restaurants to Walmart. Economic uncertainty drives traffic to the lowest-cost provider.

Grocery demand stability: People always need to eat. Unlike discretionary purchases that fluctuate with the economy, grocery sales remain remarkably consistent.

Offline + online integration: The hybrid model captures customers who want different things at different times—convenience of delivery when time-pressed, in-person browsing when shopping is leisure, curbside pickup when balancing both.

Advertising and data monetization growth: As retail margins compress industry-wide, Walmart’s advertising business provides a high-margin growth engine. This revenue stream is still in early innings compared to its potential.

Scale advantage that compounds over time: Every new store increases purchasing power with suppliers. Every additional customer improves data quality. Every fulfillment center optimization lowers costs across the entire network. Competitive advantages that compound are the most durable kind.

Key Lessons Founders Can Learn from Walmart

Volume can beat margin if systems are strong: You don’t need 40% gross margins if you can achieve massive scale with operational excellence. Low margins create barriers to entry when coupled with efficient systems.

Logistics is a competitive advantage: Your supply chain can be harder to copy than your product. Invest in operational infrastructure, not just customer-facing features.

Private labels improve profitability: Owning your brand eliminates the brand tax. Whether you’re a retailer creating house brands or a software company offering managed services, controlling more of the value chain increases margins.

Physical infrastructure can be a moat: In the digital age, we forget that real estate, warehouses, and distribution networks require massive capital and time to build. These aren’t dead weight they’re competitive barriers.

Pricing strategy is a brand strategy: Walmart’s brand is low prices. They’ve made peace with the fact that they’ll never be cool or aspirational. They’ve leaned into their positioning so completely that it became unassailable. Know what you stand for and deliver it relentlessly.

Conclusion

Walmart’s business model proves that boring fundamentals done at massive scale can outperform flashy innovation. It’s not about selling cheap it’s about building systems that make low prices sustainable.

While tech startups chase viral growth and venture capital, Walmart demonstrates the enduring power of operational excellence, customer obsession, and compounding advantages. The company isn’t sexy. It doesn’t make headlines with moonshot projects. But it makes $15+ billion in annual profit by doing unglamorous work exceptionally well.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.