CDG Zig’s business model combines ride-hailing, taxi aggregation, fleet ownership, and platform commissions, allowing ComfortDelGro to monetise both digital bookings and physical transport assets.

Unlike pure-play ride-hailing apps that rely solely on independent drivers, CDG Zig operates as a hybrid platform leveraging ComfortDelGro’s extensive taxi fleet while also functioning as a digital marketplace connecting riders with drivers. This unique positioning allows the company to generate revenue from multiple touchpoints: platform fees from digital bookings, fleet leasing income from taxi operators, and commission-based earnings from completed rides.

To understand CDG Zig properly, we need to look at how the app, drivers, and ComfortDelGro’s transport infrastructure work together to create a sustainable mobility ecosystem.

What Is CDG Zig?

CDG Zig represents ComfortDelGro’s strategic evolution from a traditional taxi operator into a modern mobility platform. Originally known as the ComfortDelGro app, the platform was rebranded as Zig to signal a fresh, tech-forward approach to urban transportation.

The rebranding wasn’t just cosmetic. It reflected ComfortDelGro’s ambition to compete more effectively against ride-hailing giants while maintaining its core strength: operating Singapore’s largest taxi fleet. Zig positions itself as a bridge between the reliability of traditional taxi services and the convenience of modern app-based booking.

In Singapore’s mobility ecosystem, CDG Zig occupies a unique middle ground. It’s not purely a taxi booking app, nor is it a typical ride-hailing platform like Grab or Gojek. Instead, it’s a vertically integrated mobility service that controls both the digital platform and a significant portion of the physical transport infrastructure.

The key difference between CDG Zig and pure ride-hailing apps lies in asset ownership. While Grab and Gojek operate as asset-light marketplaces connecting independent drivers with riders, CDG Zig is backed by thousands of ComfortDelGro-owned or affiliated taxis. This gives the platform inherent advantages in supply reliability, regulatory compliance, and service consistency.

The Problem CDG Zig Solves

Before CDG Zig’s evolution into a comprehensive mobility platform, Singapore’s taxi ecosystem faced several persistent challenges that affected both riders and drivers.

The taxi booking experience was fragmented. Riders had to choose between hailing a cab on the street, calling a dispatch center, or using multiple competing apps—each with different pricing structures, availability levels, and user experiences. This fragmentation created friction and uncertainty, especially during peak hours or bad weather.

Idle taxi capacity remained a significant inefficiency. Despite having thousands of taxis on the road, traditional dispatch systems struggled to match supply with demand effectively. Drivers often cruised empty streets looking for passengers, while riders in other areas struggled to find available cabs. This mismatch represented lost revenue for drivers and poor service for customers.

Competition from ride-hailing apps intensified these challenges. When Grab and Uber entered the Singapore market, they offered seamless digital experiences that made traditional taxi booking feel outdated. Taxi drivers and operators found themselves losing customers to these new platforms, which often offered promotional pricing and superior app interfaces.

The need for predictable pricing and trusted drivers became more apparent as the market evolved. While dynamic pricing on ride-hailing apps could create uncertainty and occasional price surges, many riders valued the predictability of metered fares and the assurance of professionally licensed taxi drivers. This represented an opportunity for a platform that could combine digital convenience with traditional taxi reliability.

CDG Zig’s Core Value Proposition

CDG Zig’s value proposition works on two distinct but interconnected levels, addressing the needs of both riders and drivers within a single ecosystem.

For Riders

Reliable, regulated transport stands at the core of what CDG Zig offers passengers. Every taxi accessible through the platform operates under Singapore’s strict licensing regime, meaning drivers have undergone professional training, background checks, and regular vehicle inspections. This regulatory oversight provides peace of mind that pure ride-hailing platforms cannot always guarantee.

Fixed or metered fares eliminate the uncertainty of dynamic pricing. Riders know that their fare will be calculated based on transparent, government-regulated rates rather than surge pricing algorithms. For regular commuters and budget-conscious travelers, this predictability is valuable.

Access to Singapore’s largest taxi fleet means better availability, especially during peak periods when ride-hailing cars might be scarce or expensive. ComfortDelGro’s extensive network of taxis provides a supply buffer that helps ensure riders can find a ride when they need one.

For Drivers & Fleet Operators

Steady ride demand through the platform reduces the feast-or-famine cycles that can affect independent ride-hailing drivers. By plugging into ComfortDelGro’s established customer base and corporate contracts, drivers gain access to consistent bookings.

Lower dependency on surge-based platforms allows drivers to earn stable incomes without relying on dynamic pricing periods. While surge pricing can occasionally boost earnings, it also creates income volatility that makes financial planning difficult.

Access to ComfortDelGro’s ecosystem provides tangible benefits beyond just ride matching. Drivers and fleet operators benefit from the company’s maintenance infrastructure, insurance arrangements, financing options, and institutional relationships that individual operators would struggle to access independently.

Target Customers

CDG Zig serves a diverse customer base, each segment with distinct needs and usage patterns.

Daily commuters form a core user group, particularly those who value consistency and reliability over price optimization. These riders typically use the app for regular trips—home to office, school runs, or routine errands—where predictable pricing and service quality matter more than finding the absolute cheapest option.

Airport travellers represent a high-value segment. Trips to and from Changi Airport generate premium fares and are often booked in advance, allowing for better demand forecasting. Business travelers and tourists alike prefer the assurance of regulated taxis for these important journeys.

Corporate and business users access CDG Zig through enterprise booking arrangements. Companies value the simplified billing, professional service standards, and compliance documentation that come with using licensed taxis for employee transportation. This B2B segment generates stable, predictable revenue.

Taxi drivers and fleet operators are customers in their own right. They use the platform to access ride demand, and many also lease vehicles or purchase related services from ComfortDelGro. This dual role—as both service providers and customers—creates a sticky relationship between drivers and the platform.

CDG Zig Business Model Explained

Understanding how CDG Zig operates requires seeing the platform as an ecosystem rather than just an app. The business model orchestrates interactions between multiple stakeholders, creating value at each touchpoint.

When riders book rides via Zig, they interact with a digital interface that feels similar to any modern ride-hailing app. They enter pickup and destination points, see estimated fares, and can track their assigned driver in real-time. The app handles payment processing, trip history, and receipts—all the conveniences users expect from digital services.

Drivers receive jobs through the platform in real-time. The system automatically matches nearby available taxis with ride requests, optimizing for factors like distance, wait times, and driver preferences. Drivers accept or decline jobs through their own driver-facing app, creating a fluid marketplace.

ComfortDelGro manages fleet, compliance, and infrastructure in the background. This includes vehicle procurement and maintenance, regulatory compliance, driver training and support, insurance coverage, and the physical infrastructure like taxi stands and service centers. This operational backbone differentiates CDG Zig from asset-light competitors.

The platform earns through commissions and service fees at multiple points in this value chain. When a ride completes successfully, CDG Zig takes a percentage commission. Booking fees may apply for certain services. Fleet operators pay leasing fees for vehicles. Corporate clients are charged service fees for enterprise booking arrangements.

This multi-layered revenue model allows CDG Zig to monetize both the digital matching service and the physical transport infrastructure—a hybrid approach that creates multiple income streams.

How CDG Zig Makes Money

CDG Zig’s revenue model draws from several distinct streams, each contributing to the platform’s overall financial sustainability.

Commission on completed rides forms the most direct revenue source. When a rider books and completes a trip through the Zig app, the platform takes a percentage of the fare. This commission compensates CDG Zig for providing the matching technology, payment processing, customer support, and brand trust that facilitate the transaction.

Booking and platform service fees add incremental revenue. These may include booking fees for airport pickups, advance reservations, or premium service tiers. Unlike commissions which are percentage-based, service fees are often fixed amounts that improve margins on lower-value trips.

Fleet and driver leasing revenue represents a unique advantage of CDG Zig’s asset-heavy model. ComfortDelGro leases vehicles to taxi operators through various rental arrangements. These leasing agreements generate steady, recurring revenue independent of ride volume, creating financial stability that pure marketplace platforms lack.

Corporate transport contracts provide high-value, predictable revenue. Enterprise clients sign agreements for employee transportation services, often with minimum commitment levels. These B2B relationships generate larger transaction values and longer customer lifetime value compared to individual consumer bookings.

Future monetisation opportunities remain largely untapped but represent significant potential. Advertising space within the app could target captive audiences during trip booking or waiting periods. Data insights about urban mobility patterns could be valuable to city planners, retailers, and other businesses. Strategic partnerships with hotels, shopping centers, or event venues could create referral revenue.

Cost Structure: Where CDG Zig Spends Money

Running CDG Zig involves substantial operating costs across multiple categories, reflecting both its digital platform and physical fleet operations.

App development and maintenance requires ongoing investment. The platform must continuously evolve to match user expectations shaped by global tech leaders. This includes mobile app updates, backend infrastructure, payment system security, data analytics capabilities, and customer-facing features. Technology talent in Singapore commands premium salaries, making this a significant cost center.

Driver onboarding and support creates continuous expenses. Every new driver requires background checks, training, documentation processing, and integration into the system. Ongoing support includes helpdesks, dispute resolution, and performance management—all labor-intensive activities that scale with fleet size.

Fleet management and operations represent the largest cost category. This encompasses vehicle acquisition or leasing, routine maintenance and repairs, fuel or electricity costs for any company-owned vehicles, insurance premiums, parking and storage facilities, and replacement cycles as vehicles age. These asset-heavy costs dwarf the expenses of asset-light competitors.

Compliance and regulatory costs are unavoidable in Singapore’s heavily regulated taxi industry. This includes licensing fees, safety inspections, driver certification programs, regulatory reporting, and legal counsel to navigate evolving transportation regulations. While these costs create barriers to entry that protect CDG Zig, they also pressure margins.

Marketing and incentives compete for rider attention and driver participation. Customer acquisition campaigns, promotional discounts, driver sign-up bonuses, and loyalty program rewards all reduce short-term profitability in service of growth and market share. Balancing these investments against lifetime customer value remains an ongoing challenge.

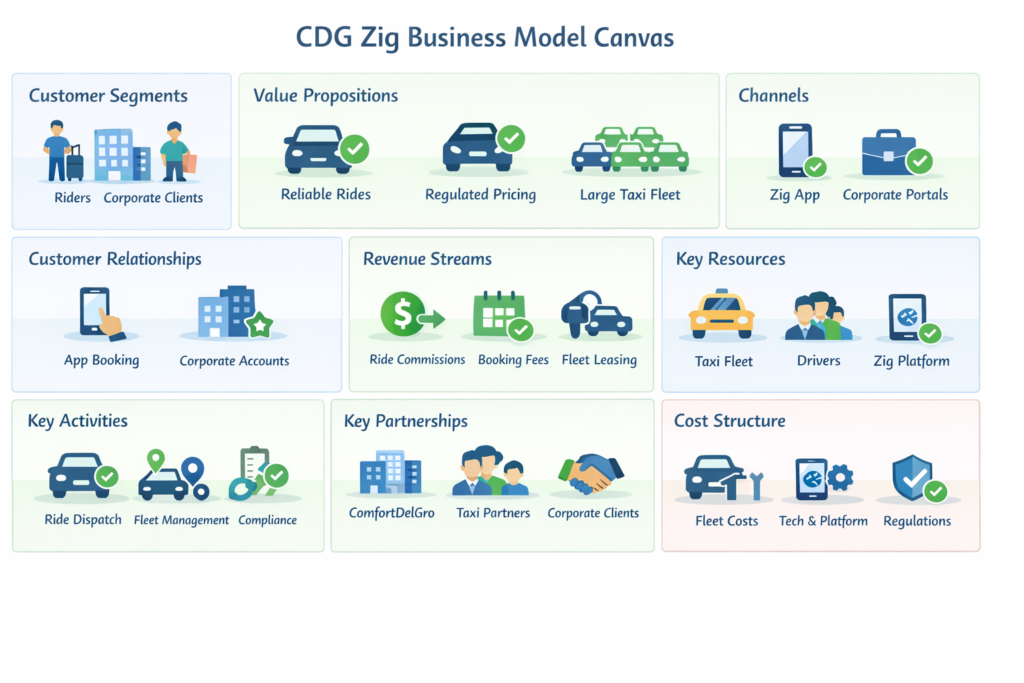

Business Model Canvas: CDG Zig Explained

The Business Model Canvas provides a structured framework for understanding how CDG Zig creates, delivers, and captures value across nine essential building blocks.

Customer Segments

CDG Zig serves multiple distinct customer groups, each with unique needs and value expectations.

Riders divide into individual consumers and corporate clients. Individual riders seek convenient, reliable transportation for personal trips, while corporate clients need scalable solutions for employee transportation with proper billing and compliance documentation.

Taxi drivers represent a crucial customer segment in their own right. They use the platform to access ride demand and earn income, making them both service providers and platform customers.

Fleet operators who lease vehicles from ComfortDelGro or operate taxis under affiliated brands form another customer category. They purchase or rent vehicles, maintenance services, and insurance products while using the platform for ride distribution.

Value Propositions

The platform delivers differentiated value to each customer segment.

Reliable rides backed by regulatory oversight give riders confidence in service quality and safety. Unlike unregulated ride-sharing, every trip meets government standards for driver qualifications and vehicle condition.

Regulated pricing eliminates the uncertainty and sticker shock of surge pricing. Riders appreciate knowing that fares follow transparent, predictable formulas rather than real-time demand algorithms.

Fleet-backed availability means riders can typically find a car even during peak periods when ride-hailing platforms face supply shortages. ComfortDelGro’s large captive fleet provides a supply buffer.

For drivers, the value proposition includes steady demand from the platform’s established customer base, access to corporate contracts that independent drivers couldn’t secure alone, and integration with ComfortDelGro’s broader ecosystem of financing, maintenance, and support services.

Channels

CDG Zig reaches customers through multiple touchpoints.

The Zig mobile app serves as the primary consumer interface, available for both iOS and Android. The app handles trip booking, payment processing, driver communication, and trip history.

Corporate booking portals provide enterprise clients with specialized interfaces that include employee management, cost center allocation, reporting dashboards, and integration with corporate payment systems.

Partner integrations extend CDG Zig’s reach through collaborations with hotels, airports, shopping centers, and other venues where transportation demand concentrates. These partnerships create convenient booking touchpoints and cross-promotional opportunities.

Customer Relationships

CDG Zig maintains relationships with its various customer segments through different mechanisms.

App-based self-service handles most routine interactions, allowing riders to book trips, track drivers, process payments, and access trip history without human intervention. This scalable approach keeps operational costs manageable while providing instant service.

Loyalty programs reward frequent riders with benefits like priority booking, discounted fares, or points redeemable for free rides. These programs increase switching costs and encourage habit formation.

Corporate account management assigns dedicated representatives to enterprise clients, providing personalized service, customized reporting, and proactive support that justifies premium pricing for B2B relationships.

Revenue Streams

CDG Zig monetizes its platform through multiple channels.

Ride commissions take a percentage of each completed trip’s fare, aligning the platform’s success with transaction volume and value.

Booking fees add fixed charges for specific services like airport pickups or advance reservations, improving margins on trips where riders value guaranteed availability.

Leasing and fleet services generate recurring revenue from taxi operators who rent vehicles or purchase related services from ComfortDelGro. This creates financial stability independent of ride volumes.

Key Resources

CDG Zig’s competitive position rests on several critical assets.

The taxi fleet represents a massive physical asset that competitors cannot easily replicate. Thousands of vehicles provide supply reliability that pure marketplace platforms struggle to match.

The driver network includes professional, licensed taxi drivers with local knowledge and customer service training. This human capital differentiates the service from platforms relying on gig economy drivers with minimal vetting.

The technology platform encompasses the mobile apps, matching algorithms, payment systems, and data infrastructure that enable digital booking and operations.

The ComfortDelGro brand carries decades of trust and recognition in Singapore. This intangible asset reduces customer acquisition costs and provides credibility that new entrants must build from scratch.

Key Activities

Running CDG Zig requires executing several core processes effectively.

Ride matching algorithms must efficiently pair riders with nearby available drivers, optimizing for wait times, route efficiency, and driver utilization. The quality of this matching directly impacts customer satisfaction and operational efficiency.

Fleet operations involve maintaining thousands of vehicles, managing driver schedules, optimizing vehicle deployment across the city, and ensuring regulatory compliance. These activities differentiate CDG Zig from software-only competitors.

Platform maintenance requires continuously updating mobile apps, securing payment systems, analyzing performance data, and adding features that keep pace with user expectations shaped by global technology leaders.

Compliance management ensures adherence to Singapore’s transportation regulations, including driver licensing, vehicle inspections, fare transparency, and safety standards. This activity creates barriers to entry but also consumes significant management attention.

Key Partnerships

CDG Zig’s ecosystem depends on relationships with various external partners.

ComfortDelGro subsidiaries provide vehicles, maintenance services, insurance products, and operational support. These internal partnerships create vertical integration advantages.

Drivers and taxi companies affiliated with ComfortDelGro supply the labor and vehicles that fulfill ride demand. Managing these relationships effectively ensures adequate supply and service quality.

Corporate clients who sign enterprise transportation agreements provide stable, high-value revenue while helping fill capacity during business hours.

Payment providers enable seamless digital transactions, supporting multiple payment methods including credit cards, digital wallets, and corporate billing systems.

Cost Structure

CDG Zig’s expenses reflect both digital platform operations and physical fleet management.

Fleet operations including vehicle acquisition, maintenance, fuel, insurance, and facilities represent the largest cost category, distinguishing CDG Zig’s economics from asset-light platforms.

Technology and infrastructure costs cover app development, cloud hosting, data analytics, cybersecurity, and payment processing fees.

Driver incentives include sign-up bonuses, performance rewards, and promotional campaigns to maintain adequate driver supply and engagement.

Regulatory compliance encompasses licensing fees, safety inspections, legal counsel, and administrative overhead to meet Singapore’s transportation regulations.

CDG Zig vs Grab vs Gojek: Business Model Comparison

Understanding CDG Zig’s business model becomes clearer when contrasted with its primary competitors in Singapore’s mobility market.

The most fundamental difference lies in the asset-heavy versus asset-light approach. CDG Zig owns or controls a significant taxi fleet, creating high capital requirements but also supply reliability and operational control. Grab and Gojek operate as pure marketplaces, connecting independent drivers with riders without owning vehicles. This makes them more capital-efficient but also more vulnerable to supply shortages during peak demand.

Pricing control follows from this structural difference. CDG Zig largely operates on government-regulated metered fares, providing price predictability but limiting pricing flexibility. Grab and Gojek use dynamic pricing algorithms that adjust fares based on real-time supply and demand, maximizing revenue during peaks but potentially alienating price-sensitive customers.

Driver relationships differ fundamentally. CDG Zig’s drivers are either employees or franchisees operating under taxi licenses with close ties to ComfortDelGro. Grab and Gojek drivers are independent contractors who can multi-home between platforms, reducing loyalty but increasing flexibility. This affects service consistency, training standards, and the platform’s ability to enforce quality controls.

Regulatory advantage strongly favors CDG Zig in Singapore’s heavily regulated market. The company has decades of experience navigating taxi regulations and maintaining relationships with transport authorities. Grab and Gojek must continuously adapt to evolving rules for private hire vehicles, which can suddenly impact their cost structures or operational models.

However, CDG Zig faces disadvantages in innovation speed and service breadth. Asset-light competitors can pivot more quickly, experiment with new features, and expand into adjacent services like food delivery or payments without being constrained by legacy fleet operations. CDG Zig’s strength in core taxi services comes at the cost of agility in exploring new business lines.

Growth Strategy & Expansion

CDG Zig’s growth strategy leverages ComfortDelGro’s existing strengths while selectively expanding into adjacent opportunities.

Strengthening taxi dominance in Singapore remains the core priority. Rather than trying to compete head-to-head with Grab across all ride categories, CDG Zig focuses on segments where taxi services maintain advantages: corporate transportation, airport transfers, longer-distance trips, and customers who value regulated service and predictable pricing. By dominating these profitable niches, the platform can generate sustainable margins without winning every ride-hailing transaction.

Corporate and airport travel focus creates defensible revenue streams. Enterprise clients value the compliance documentation, professional drivers, and predictable pricing that CDG Zig provides. Airport transfers represent premium fares where reliability and professionalism matter more than marginal price differences. These segments generate higher average revenues with better margins than short urban trips.

Regional expansion via ComfortDelGro network offers organic growth opportunities. ComfortDelGro operates taxi and bus services in multiple countries including Australia, China, the UK, and Vietnam. CDG Zig could potentially expand as a mobility platform for these existing operations, leveraging shared technology infrastructure and operational expertise across markets. This approach reduces expansion risk compared to entering entirely new geographies.

Multi-service mobility potential represents longer-term upside. CDG Zig could evolve beyond taxis to become a comprehensive transportation platform integrating buses, carpooling, bike-sharing, or even last-mile delivery. ComfortDelGro already operates several of these services separately. Consolidating them under a unified digital platform could create a super-app for urban mobility, though execution remains challenging.

Risks & Challenges in CDG Zig’s Business Model

Despite its strengths, CDG Zig faces significant headwinds that could limit growth or pressure profitability.

High operating costs inherent to the asset-heavy model create structural disadvantages. Fleet ownership requires massive capital investment with long payback periods. Maintenance, insurance, depreciation, and facilities costs create fixed expenses that don’t scale down during demand downturns. Competitors with asset-light models can achieve higher operating leverage and potentially undercut on price while maintaining margins.

Competition from ride-hailing giants with deeper pockets and global scale poses an existential threat. Grab raised billions in venture capital and can sustain losses while building market share. Its super-app strategy integrating payments, food delivery, and financial services creates network effects and cross-subsidization opportunities unavailable to CDG Zig. If Grab chooses to aggressively compete for taxi-like services, it could erode CDG Zig’s core market.

Slower innovation compared to startups reflects organizational realities. ComfortDelGro’s decades of traditional operations create institutional inertia. Decision-making processes designed for stable, regulated businesses don’t adapt easily to fast-moving technology markets. While startups can pivot quickly and experiment with new features, CDG Zig must navigate corporate approval processes and legacy system constraints.

Regulatory changes could unexpectedly level the playing field or create new disadvantages. If Singapore’s government loosens restrictions on private hire vehicles or reduces the regulatory burden for ride-hailing, CDG Zig loses a key competitive advantage. Conversely, overly strict new regulations could increase operating costs without proportionally affecting asset-light competitors.

What Founders Can Learn from CDG Zig

CDG Zig’s business model offers valuable lessons for entrepreneurs, even those building very different types of businesses.

How asset-heavy models can still win in supposedly “disrupted” industries demonstrates that technology doesn’t always favor asset-light approaches. In markets where supply reliability, quality control, or regulatory compliance matter intensely, owning assets can create competitive moats. The key is ensuring the advantages of control and vertical integration exceed the costs of capital intensity and operational complexity.

Importance of regulatory alignment shows that working with rather than against regulations can build sustainable advantages. While many startups celebrate regulatory arbitrage operating in gray areas before rules catch up CDG Zig benefits from full compliance and strong relationships with authorities. In heavily regulated industries, being the “safe choice” for risk-averse customers creates durable value.

Platform plus infrastructure hybrid advantage suggests that combining digital marketplaces with physical assets can create unique value propositions. Pure marketplaces scale efficiently but struggle with supply reliability and quality consistency. Pure asset operators control quality but lack the flexibility and data insights of platforms. Hybrids that successfully manage both can defend premium pricing.

Local dominance before global expansion proves that winning your home market thoroughly can be more valuable than rapid international growth. CDG Zig has deep roots in Singapore’s transportation ecosystem, giving it advantages that foreign entrants struggle to replicate. This local strength generates sustainable cash flows that can eventually fund selective expansion, rather than spreading resources thinly across many markets simultaneously.

Final Take: Is CDG Zig’s Business Model Sustainable?

Evaluating CDG Zig’s long-term viability requires weighing structural strengths against competitive pressures and market evolution.

The model’s core strengths provide genuine competitive advantages. Fleet ownership creates supply reliability that pure marketplaces cannot guarantee, particularly during peak demand periods. Regulatory compliance and professional driver standards appeal to risk-averse customers and corporate clients willing to pay for peace of mind. Integration with ComfortDelGro’s broader transport ecosystem generates revenue diversification and operational synergies. The established brand carries trust built over decades.

Long-term defensibility depends on whether these advantages can sustain premium pricing and market share against aggressive competitors. In Singapore’s mature, tech-savvy market, customer loyalty is finite. If price gaps with ride-hailing alternatives widen too much, even quality-conscious users may switch. The model’s sustainability hinges on maintaining a customer segment that values reliability and regulation enough to justify higher costs.

Why Zig is not just “another taxi app” becomes clear when viewing it as infrastructure-enabled mobility rather than a pure software play. Traditional taxi apps simply digitized dispatch connecting riders to existing taxi supply through mobile interfaces. CDG Zig represents vertical integration of digital platform and physical transport capacity, creating a hybrid that combines aspects of Uber’s marketplace model with traditional taxi company operations.

This positioning creates both opportunities and constraints. CDG Zig won’t achieve the valuation multiples or growth rates of pure tech platforms, but it also doesn’t need to. By generating sustainable cash flows from integrated operations, maintaining dominant share in profitable segments, and leveraging existing assets rather than building from scratch, the model can succeed without requiring venture-scale outcomes.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.