Short answer: Uber’s core business model is a platform-based marketplace that connects riders with independent drivers and takes a commission from every completed ride.

In simple words: Uber doesn’t own cars or employ drivers it owns the technology that matches demand and supply at scale.

What Does “Core Business Model” Mean in Uber’s Case?

When we talk about Uber’s core business model, we’re talking about the fundamental way it creates and captures value not its side projects or expansions.

Here’s what makes Uber different:

Uber is not a taxi company. Traditional taxi companies own vehicles, employ drivers, and manage fleets. Uber does none of that. It’s a technology company that built a platform connecting two groups: people who need rides and people who can provide them.

Platform vs asset-heavy businesses: An asset-heavy business (like a traditional taxi company) needs to buy cars, hire drivers, maintain vehicles, and manage logistics in every city. Uber skips all that. It’s an asset-light platform its main asset is software, not physical infrastructure.

This distinction is critical. It’s why Uber could expand to hundreds of cities faster than any taxi company ever could.

Uber’s Core Business Model in One Line

Uber operates a two-sided digital platform where riders demand trips, drivers supply trips, and Uber earns a percentage by facilitating the transaction.

That’s it. Everything else the app design, surge pricing, driver ratings is built to make this core engine work better.

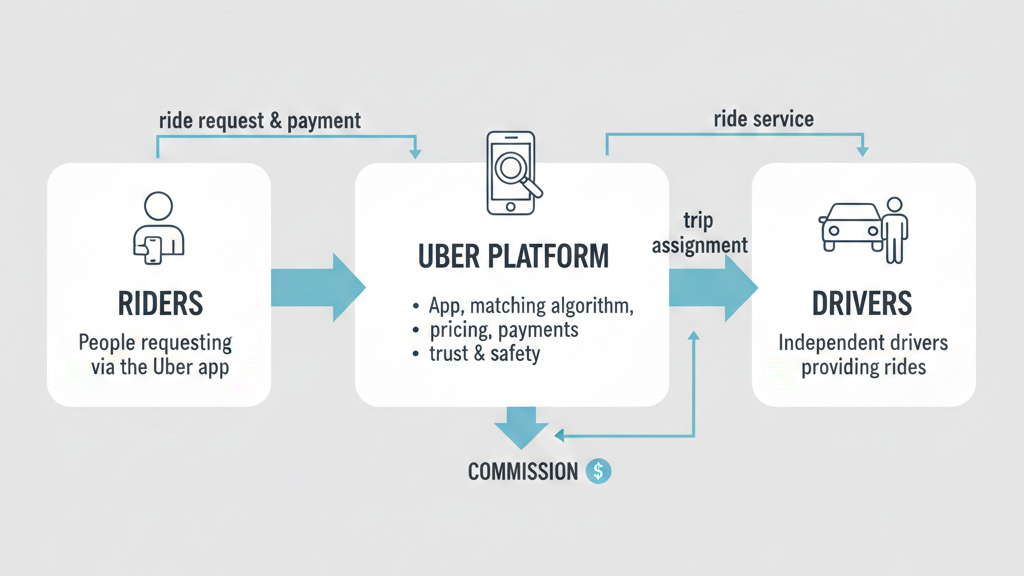

Key Players in Uber’s Business Model

Uber’s model has three main players:

1. Riders (customers)

People who need transportation. They download the app, request a ride, and pay through the platform.

2. Drivers (independent partners)

Individuals who own cars and want flexible income. They sign up, accept ride requests, and provide the service.

3. Uber (the platform)

The middleman that connects riders and drivers. Uber provides the app, handles payments, manages trust through ratings, sets pricing rules, and takes a cut.

How value flows:

- Riders get convenient, cashless transportation without owning a car

- Drivers get flexible income without the overhead of running a taxi business

- Uber gets paid for making the connection seamless, safe, and scalable

Everyone benefits — that’s why the model works.

How Uber Creates Value (The Real Logic)

Uber doesn’t just “connect” people. It creates real value on both sides of the platform:

For riders:

- Convenience: No need to call a taxi or wave one down. A car arrives in minutes with a tap.

- Transparency: You see the driver’s name, photo, car, rating, and estimated arrival time upfront.

- Cashless payment: Everything happens automatically through the app.

- Competitive pricing: Often cheaper than traditional taxis, especially in competitive markets.

For drivers:

- Flexible income: Work whenever you want. No boss, no shifts, no taxi medallion required.

- Access to demand: Uber aggregates millions of riders. Drivers don’t need to hunt for customers.

- Simplified logistics: Uber handles payments, insurance partnerships, and customer acquisition.

For Uber itself:

- Demand aggregation: Uber pools millions of ride requests, giving it massive data and pricing power.

- Trust layer: Ratings, background checks, and insurance create a safer experience than street hailing.

- Algorithm efficiency: The more rides happen, the smarter Uber’s matching and pricing algorithms become.

This is the real magic: Uber makes transportation easier for riders and more profitable for drivers, while taking a cut for orchestrating it all.

How Uber Makes Money at the Core Level

Uber’s revenue model is straightforward:

1. Commission per ride

Uber takes a percentage of every fare typically 20-30%, depending on the city and driver agreement. The driver keeps the rest.

Example: If a ride costs $20, Uber might take $5, and the driver keeps $15.

2. Dynamic pricing (surge pricing)

When demand is high (like Friday night or during a rainstorm), Uber raises prices. This encourages more drivers to get on the road and balances supply and demand. Uber’s commission grows when fares go up.

3. Service and platform fees

In some markets, Uber charges riders a small booking fee or service charge on top of the fare. This covers costs like payment processing, support, and tech maintenance.

That’s the core revenue engine. No ads, no subscriptions (at the core level), no product sales — just facilitating transactions and taking a percentage.

Why Uber’s Business Model Scales So Fast

Uber went from one city to over 10,000 cities in about a decade. How?

1. No vehicle ownership

Uber doesn’t buy cars. Drivers bring their own. This eliminates the biggest cost and bottleneck of traditional taxi companies.

2. Local supply, global software

The Uber app works the same everywhere. Once built, it can be deployed in any city without rebuilding the core platform. Only local operations (driver onboarding, regulation compliance) need customization.

3. Network effects

The more riders use Uber, the more attractive it becomes for drivers (more income opportunity). The more drivers join, the better the service for riders (shorter wait times). This creates a self-reinforcing cycle.

4. Demand-supply matching improves with scale

The more data Uber collects, the better its algorithm gets at predicting demand, pricing trips, and routing drivers. This makes the whole system more efficient over time.

Bottom line: Uber’s model is designed to scale. Once the platform works in one city, copying it to the next is relatively cheap and fast.

Is Uber an Asset-Light or Asset-Heavy Business?

Uber is asset-light.

Here’s what that means:

What Uber does NOT own:

- Cars

- Garages or parking lots

- Fuel stations

- Driver payroll infrastructure (drivers are independent contractors)

What Uber DOES own:

- The software platform (app, algorithms, backend systems)

- Massive amounts of data (trips, routes, pricing, behavior)

- The brand and marketplace network

- Intellectual property (patents, technology)

Why this matters:

Asset-light businesses have lower upfront costs, faster expansion, and higher profit margins (in theory). They don’t need billions in capital to buy fleets or build infrastructure. They just need great software and good execution.

However, being asset-light also means Uber has less control over quality. If drivers provide bad service, Uber’s reputation suffers — even though it doesn’t employ those drivers.

What Uber Is NOT at Its Core

Let’s clear up some common confusion:

Uber is NOT a taxi company.

Taxi companies own vehicles and employ drivers. Uber owns software and connects independent drivers with riders.

Uber is NOT an employer of drivers.

Drivers are independent contractors, not employees. This is a key (and controversial) part of Uber’s model. It keeps costs low but raises questions about worker rights and benefits.

Uber is NOT a car rental service.

Uber doesn’t rent cars to passengers. It connects passengers with drivers who provide transportation as a service.

Understanding what Uber isn’t helps clarify what makes its model unique — and sometimes legally complicated.

How Uber Expanded Beyond Its Core Model

While ride-hailing is the core, Uber has applied the same platform logic to other markets:

Uber Eats

Connects hungry customers with restaurants and delivery drivers. Same three-sided marketplace, different product (food instead of rides).

Uber Freight

Connects trucking companies with shippers who need goods transported. Same commission-based platform model, applied to logistics.

Uber One (subscriptions)

A membership program offering discounts on rides and food delivery. This adds recurring revenue on top of the core transaction model.

The pattern: Uber’s core platform logic — connect supply and demand, facilitate transactions, take a cut — works across many industries. The infrastructure (app, payments, ratings) is reusable.

But at its heart, Uber is still a ride-hailing platform. That’s where it started, and that’s still the biggest revenue driver.

Uber Core Business Model Summary (Quick Recap)

Let’s wrap it up:

- Platform marketplace: Uber connects riders and drivers through software, not physical assets.

- Two-sided network: Value is created for both riders (convenience) and drivers (income).

- Commission-based revenue: Uber earns by taking a percentage of every transaction.

- Asset-light, software-driven: No car ownership, no driver payroll — just tech and data.

This model enabled Uber to scale globally, disrupt transportation, and redefine how people think about mobility.

Founder Insight / Business Model Lesson

Why platform businesses win:

Platforms like Uber can scale faster than traditional businesses because they leverage other people’s assets (cars, labor, time) without owning them. Once the network effects kick in, they become very hard to compete with.

What startups can copy from Uber:

- Focus on connection, not ownership. You don’t need to own the assets; you need to own the best way to connect supply and demand.

- Design for network effects. Every new user should make the platform more valuable for everyone else.

- Start with a wedge. Uber began with black car service in San Francisco, then expanded. Find your beachhead before going global.

What NOT to copy:

- Capital burn: Uber lost billions subsidizing rides to build market share. Most startups can’t afford that. Focus on sustainable unit economics earlier.

- Regulation battles: Uber fought governments worldwide. That works if you have billions in venture capital. For most founders, it’s better to work within existing rules or find less contentious markets.

- Contractor model controversy: Uber’s treatment of drivers as contractors is legally challenged in many countries. If you’re building a platform, think carefully about how you treat your supply side — not just legally, but ethically.

Final takeaway:

Uber’s core business model is elegant: connect people who need something with people who can provide it, make the transaction seamless, and take a cut. It’s a template that works across industries if you can execute it with the right balance of technology, trust, and scale.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.