Short answer: Twitch operates on a creator-led live streaming platform business model, where it enables streamers to broadcast live content, build communities, and monetise through subscriptions, ads, donations, and brand partnerships while Twitch earns a share from each monetisation activity.

To understand why Twitch dominates live streaming for gaming and creator communities, we need to look at how its creator economy, monetisation layers, and platform incentives work together.

What Is Twitch?

Twitch launched in 2011 as a spin-off from Justin.tv, focusing exclusively on live gaming content. Amazon acquired it in 2014 for $970 million, recognising the platform’s potential to become the go-to destination for live streaming.

The problem Twitch solves: Before Twitch, gamers had nowhere to broadcast their gameplay live and build audiences around it. YouTube served pre-recorded videos well, but live interaction didn’t exist at scale. Twitch gave creators a platform to stream in real-time, chat with viewers, and earn money doing what they love.

Core users: Twitch serves three distinct groups streamers who create content, viewers who watch and engage, and advertisers who want to reach gaming audiences.

Core promise: Real-time interaction between creators and communities, combined with multiple ways for creators to earn income while doing what they’re passionate about.

Twitch’s Core Business Model Explained

Platform and Creator Economy Model

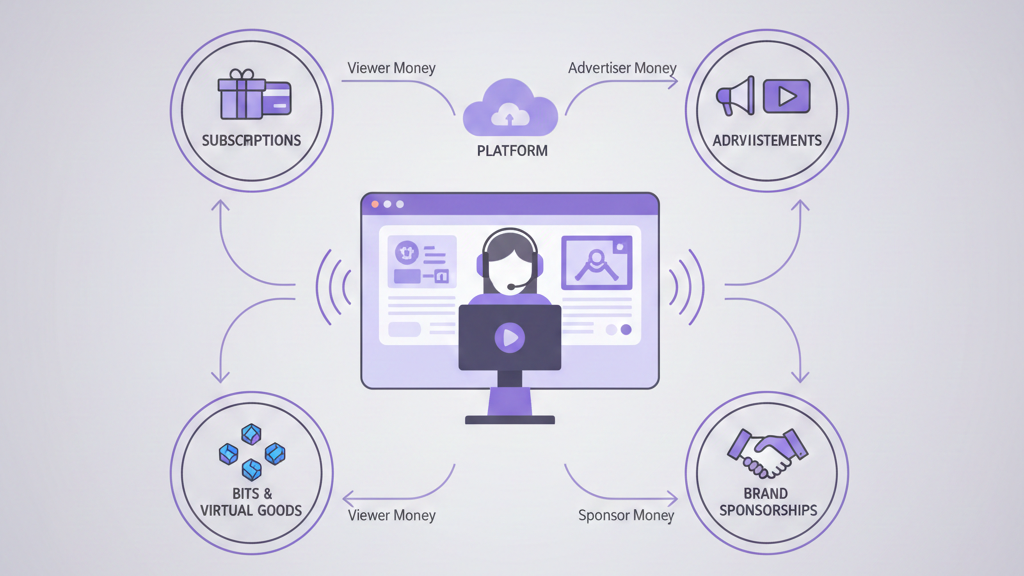

Twitch runs a two-sided platform. On one side, creators broadcast content. On the other, viewers watch, chat, and spend money. Twitch provides the infrastructure, discovery tools, and monetisation options that connect both sides.

The platform doesn’t create content itself. Creators generate everything viewers watch. Twitch’s job is making sure creators can reach audiences, build communities, and get paid for their work.

Revenue-Sharing Structure

Twitch earns money by taking a percentage of what creators make. The standard split is 50/50, though top creators negotiate better deals. This model aligns incentives—Twitch only makes money when creators make money.

The more successful creators become, the more Twitch earns. This creates a platform economy where growth compounds naturally.

How Twitch Makes Money

Subscriptions

Viewers can subscribe to channels they love for $4.99, $9.99, or $24.99 per month. Subscribers get perks like ad-free viewing, custom emotes, and badges next to their username in chat.

Twitch typically keeps 50% of subscription revenue, though popular streamers negotiate 70/30 splits. Amazon Prime members get one free channel subscription monthly through Prime Gaming, which Amazon pays for.

Advertising Revenue

Twitch runs video ads during streams pre roll ads when someone first clicks on a stream and mid-roll ads that streamers can trigger manually. Advertisers pay Twitch to reach gaming audiences, and Twitch shares a portion with streamers based on viewership.

The platform positions these ads as brand-safe placements, giving advertisers access to engaged communities watching live content.

Bits and Virtual Goods

Bits are Twitch’s virtual currency. Viewers buy them ($1.40 for 100 Bits) and spend them in chat to support creators. When someone “cheers” with Bits, animated emotes appear in chat, creating visible support.

Twitch earns the margin between purchase price and creator payout. If you buy 100 Bits for $1.40, the streamer receives $1.00. This high-margin digital goods model scales well.

Sponsorships and Brand Integrations

Major streamers negotiate brand deals directly, but Twitch also facilitates partnerships through its Bounty Board program. Brands pay for sponsored streams, and Twitch connects creators with opportunities while taking a cut.

Off-platform, successful streamers earn significant income from sponsorships, though Twitch doesn’t take a share of these deals.

Creator Monetisation Workflow

New streamers start with zero monetisation options. As they build audiences, they unlock features through Twitch’s Affiliate and Partner programs.

Affiliate status requires 50 followers, 500 total broadcast minutes, 7 broadcast days, and 3+ concurrent viewers on average. Affiliates can earn from subscriptions, Bits, and ads.

Partner status demands higher thresholds—75+ average viewers, 25+ broadcast hours over 12 days within 30 days. Partners get better revenue splits, more customisation options, and priority support.

This tiered system incentivises creators to grow their channels, knowing each milestone unlocks better earning potential.

Viewer Engagement and Retention Strategy

Twitch keeps viewers watching through real-time interaction. Chat runs alongside every stream, creating conversations between streamers and audiences. Unlike YouTube videos you watch alone, Twitch feels social.

Emotes, badges, and rewards create status systems within communities. Subscribers get exclusive emotes. Long-time subscribers display loyalty badges. These small touches build belonging.

The platform’s recommendation system suggests streams based on what you’ve watched before, though discovery remains less algorithm-driven than YouTube. Most growth happens organically through community sharing.

Parasocial relationships drive retention. Viewers return to specific streamers daily, building routines around their favorite creators’ schedules.

Technology and Platform Logic (Non-Technical)

Twitch’s infrastructure handles millions of concurrent streams and viewers. The platform transcodes video in real-time, adjusting quality based on viewer internet speeds.

Discovery systems surface popular streams on the homepage while helping smaller creators reach audiences through category browsing and tags.

Moderation tools let streamers control their communities with chat filters, ban capabilities, and moderator roles for trusted community members.

Analytics dashboards show creators their viewership patterns, revenue breakdowns, and audience demographics, helping them optimise content strategy.

Customer Acquisition Strategy

Twitch grows primarily through creators. When streamers build audiences, they bring viewers to the platform. This creator-led growth costs Twitch almost nothing in marketing spend.

Major game launches and esports events drive massive traffic spikes. When a highly anticipated game releases, thousands of streamers broadcast it simultaneously, and millions tune in to watch.

Amazon integrates Twitch across its ecosystem. Prime Gaming connects Amazon Prime members to Twitch benefits, converting existing Amazon customers into platform users.

Community-driven marketing works because viewers share clips, highlight moments, and recommend streams to friends—all free promotion for Twitch.

Cost Structure (Where Twitch Spends Money)

Video streaming infrastructure: Running millions of simultaneous high-quality video streams costs enormous amounts. Bandwidth, servers, and transcoding represent Twitch’s largest expense.

Creator payouts: Every subscription, Bits purchase, and ad view means sharing revenue with creators. As the platform grows, payouts scale proportionally.

Trust and safety operations: Moderating millions of live streams requires human reviewers, automated detection systems, and policy enforcement teams.

Product development: Engineers build new features, improve streaming quality, and maintain platform stability.

Marketing and partnerships: Though creator-led growth dominates, Twitch still invests in partnerships, events, and brand campaigns.

Unit Economics Explained Simply

Twitch makes money based on how engaged users are and how much time they spend watching. The more someone watches, the more ads they see and the more likely they subscribe or buy Bits.

Revenue per active user varies widely. Casual viewers generate minimal ad revenue. Engaged community members who subscribe and spend Bits generate significantly more.

Creator payouts versus platform margin means Twitch needs scale to profit. On a 50/50 split, infrastructure costs eat into margins, so the platform relies on volume.

Engagement time matters most. Unlike YouTube where watch time drives ads, Twitch monetises through ongoing relationships—subscriptions renew monthly, regular viewers buy Bits repeatedly.

Scale economics work in Twitch’s favor. The infrastructure costs don’t double when viewership doubles, meaning profitability improves as the platform grows.

Twitch vs Competitors (Quick Comparison)

Twitch vs YouTube Live: YouTube offers better discoverability through its recommendation algorithm, but Twitch has deeper community features and live-first culture. Creators often multi-stream, but Twitch remains their primary platform.

Twitch vs Kick: Kick launched in 2023 offering 95/5 revenue splits, aggressively poaching top creators. Twitch responds by improving partner agreements for select streamers but maintains its 50/50 default.

Community depth vs algorithm reach: YouTube pushes content to new audiences algorithmically. Twitch relies on communities to share and grow organically. Neither approach is objectively better—they serve different creator strategies.

Creator-first vs platform-first incentives: Platforms like Kick prioritise creator earnings to attract talent. Twitch balances creator, viewer, and advertiser needs, which sometimes frustrates streamers but creates platform stability.

Challenges in Twitch’s Business Model

High infrastructure costs make profitability difficult. Streaming video at scale costs more than most content platforms, and Twitch shares half its revenue with creators.

Creator revenue dissatisfaction grows as streamers compare Twitch’s 50/50 split to competitors offering better terms. Top creators leverage offers from other platforms to negotiate better deals, but most smaller streamers accept standard terms.

Competition for exclusive creators intensifies. YouTube, Kick, and others pay signing bonuses for exclusive streaming rights. Twitch loses marquee names, though its community advantages keep most creators from leaving entirely.

Brand safety and moderation issues persist. Live content creates risks—streamers occasionally violate terms of service, exposing advertisers to controversial content. Twitch invests heavily in moderation, but problems remain.

What Startups Can Learn from Twitch

Creators are the product. Platforms that enable creators to build audiences and earn income grow faster than those focusing solely on features. Your best marketing comes from empowering users to succeed.

Monetisation should feel optional, not forced. Twitch gives viewers multiple ways to support creators, but never forces spending. Subscriptions, Bits, and donations feel like choices, not paywalls.

Community drives retention better than features. People return to Twitch for specific creators and communities, not because the video player is marginally better. Build social features that create belonging.

Revenue sharing aligns incentives. When your platform earns only when users earn, everyone wins together. This model scales naturally without forcing growth.

Future of Twitch’s Business Model

Diversification beyond gaming continues. While gaming dominates, categories like Just Chatting, Music, and Creative grow rapidly. Twitch positions itself as a live streaming platform, not just a gaming site.

Better creator revenue tools will emerge. Expect improved merchandise integration, tipping features, and ways for streamers to monetise beyond subscriptions and ads.

Improved discovery for small streamers remains a priority. The platform knows that helping new creators find audiences benefits everyone long-term.

Deeper Amazon ecosystem integration makes sense. Expect more connections between Twitch, Prime Video, Amazon Music, and other Amazon properties, creating a unified entertainment ecosystem.

Wrap Up

Twitch remains the leader in live streaming because it built a creator economy where everyone benefits. Streamers earn income doing what they love. Viewers get free entertainment with optional ways to support creators. Advertisers reach engaged audiences. Twitch takes a cut from each transaction.

The creator economy serves as Twitch’s long-term moat. Competitors can copy features, but they can’t replicate the communities that formed over years on the platform. Streamers invest time building audiences, creating switching costs that protect Twitch’s market position.

Real-time communities beat on-demand content for one simple reason: people crave connection. Watching someone live, chatting with others, and being part of something happening right now creates engagement that pre-recorded videos can’t match.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.