ComfortDelGro makes money by operating buses, trains, taxis, and vehicle maintenance services across seven countries, earning revenue through passenger fares, government contracts, vehicle rentals, and engineering services. With operations in Singapore, UK, Australia, and China, the company generates approximately $3.8 billion SGD annually through its diversified transport business model.

Unlike ride-hailing startups that burn cash chasing growth, ComfortDelGro has built a sustainable business model focused on stability and consistent cash flow. This comprehensive guide breaks down exactly how ComfortDelGro operates and why this traditional transport model still thrives in 2026.

What Is ComfortDelGro? Company Overview

ComfortDelGro Corporation Limited is one of the world’s largest land transport companies, headquartered in Singapore. Founded in 2003 through the merger of Comfort Group and DelGro Corporation, the company now operates across multiple continents with a fleet exceeding 40,000 vehicles.

Key Facts:

- Operates in 7 countries including Singapore, UK, Australia, China, and Ireland

- Runs over 17,000 buses and 14,000 taxis globally

- Employs approximately 24,000 staff members

- Listed on the Singapore Exchange (SGX: C52)

Unlike technology-focused mobility startups, ComfortDelGro is an infrastructure business designed for long-term resilience rather than rapid disruption.

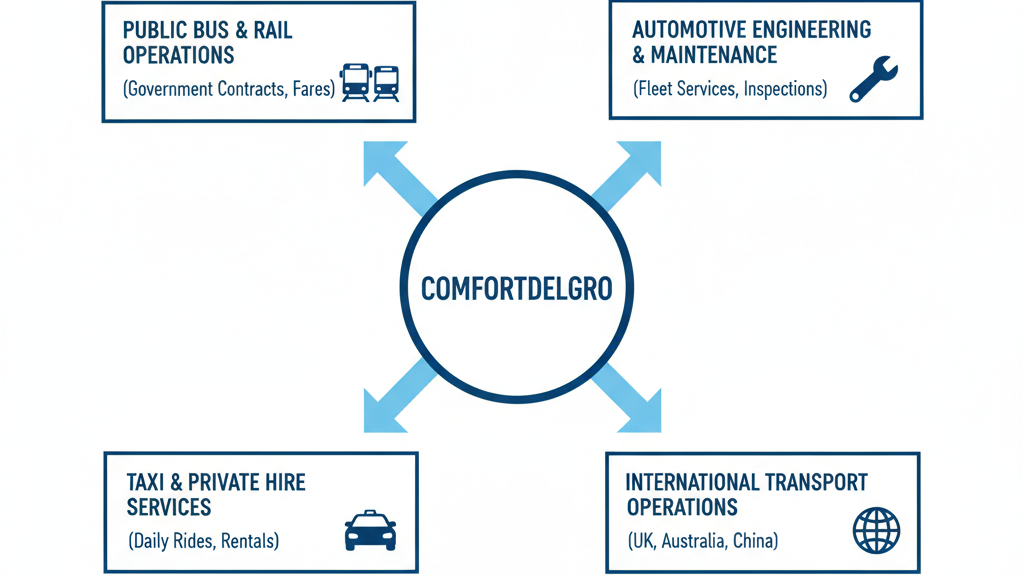

How ComfortDelGro Makes Money: Core Revenue Streams

Passenger Fares and Service Fees

The most visible revenue stream comes from millions of daily passenger trips. Every bus ride, train journey, and taxi trip generates fare revenue. In high-density markets like Singapore, this creates substantial daily cash flow.

Public bus services operate on fixed routes with regulated fares, providing predictable revenue. Taxi services operate on metered or app-based pricing, offering more variable but immediate income.

Government Operating Contracts

ComfortDelGro’s most stable revenue comes from long-term government contracts. Transport authorities in Singapore, UK, and Australia award multi-year contracts to operate public bus and rail services.

These contracts typically include:

- Fixed annual payments regardless of ridership fluctuations

- Performance bonuses for meeting service standards

- Cost-adjustment mechanisms tied to fuel prices and inflation

- Contract terms ranging from 5 to 15 years

This contract structure provides revenue visibility years in advance, making financial planning and investment decisions more predictable.

Vehicle Rental and Leasing Income

ComfortDelGro generates recurring revenue by renting vehicles to independent taxi drivers and commercial operators. Rather than drivers purchasing vehicles outright, they pay daily or weekly rental fees.

This model creates several advantages:

- Continuous cash flow from rental payments

- Vehicle ownership and depreciation stays on ComfortDelGro’s books

- Stronger relationships with drivers who become long-term clients

- Additional revenue from insurance, maintenance packages, and ancillary services

Automotive Engineering and Maintenance Services

ComfortDelGro operates vehicle inspection centers, repair workshops, and fleet management services. This segment generates revenue from:

- Mandatory vehicle inspections (required by law in most markets)

- Maintenance and repair services for owned and third-party fleets

- Fleet management contracts with corporate clients

- Parts sales and workshop services

The key advantage: this revenue stream performs independently of passenger demand. Even during periods of reduced ridership, vehicles still require maintenance and inspection.

Advertising and Ancillary Income

Bus exteriors, interiors, and transit stations provide advertising inventory. ComfortDelGro sells this space to advertisers, generating supplementary income that requires minimal additional operational cost.

Other ancillary revenue includes insurance commissions, fuel card services, and partnerships with payment providers.

ComfortDelGro’s Four Business Segments Explained

Public Transport Services: The Stability Foundation

What it includes:

- Public bus operations in Singapore, UK, Australia, China, and Ireland

- Rail and metro operations in Singapore and UK

- Government-contracted transport routes

Business model characteristics:

- Long-term contracts with government authorities

- Regulated or fixed returns on investment

- High barriers to entry requiring significant capital and regulatory approvals

- Predictable cash flows with lower profit margins

This segment represents approximately 60% of total revenue and provides the financial foundation supporting other business areas.

Taxi and Private Hire Services: The Volume Generator

What it includes:

- Comfort and CityCab taxis in Singapore

- Metrocab operations in UK

- Ride-hailing platform participation in select markets

Business model characteristics:

- Higher operational complexity with variable demand

- Daily cash generation from thousands of trips

- Competition from private ride-hailing platforms

- Greater exposure to fuel costs and driver availability

This segment balances regulated public transport with more commercial, market-driven operations.

Automotive Engineering Services: The Hidden Profit Center

What it includes:

- VICOM vehicle inspection services (Singapore’s largest inspection center)

- STA inspection services in Australia

- Maintenance workshops and repair facilities

- Fleet management consulting

Business model characteristics:

- Mandatory services required by law create captive demand

- Higher margins than transport operations

- Consistent revenue independent of ridership trends

- Serves both ComfortDelGro vehicles and external clients

This segment contributes disproportionately to profitability despite representing smaller revenue share.

Rail Operations: Growing Infrastructure Play

What it includes:

- Singapore Downtown Line operation

- UK rail franchises

- Light rail systems in select markets

Business model characteristics:

- Extremely long-term contracts (10-15 years typical)

- Significant upfront capital investment

- Regulated returns with performance incentives

- Government support for infrastructure investment

Rail operations require patient capital but offer exceptional stability once operational.

ComfortDelGro’s Cost Structure: Where Money Goes

Understanding profitability requires examining the major cost categories:

Staff Costs and Driver Wages

Personnel expenses represent the largest cost component, typically 35-40% of revenue. This includes:

- Driver salaries and benefits

- Workshop technicians and mechanics

- Administrative and management staff

- Training and development programs

Labor shortages in key markets continue pressuring wages upward, compressing margins.

Fleet Acquisition and Depreciation

Purchasing buses, trains, and taxis requires substantial capital. ComfortDelGro invests hundreds of millions annually in fleet renewal, with vehicles depreciated over 8-15 years depending on type.

Fuel and Energy Costs

Diesel, electricity, and alternative fuels represent 15-20% of operating costs. While fuel escalation clauses in government contracts provide some protection, private hire and taxi operations face full exposure to energy price volatility.

Maintenance and Operating Expenses

Keeping thousands of vehicles roadworthy requires continuous spending on parts, repairs, insurance, and regulatory compliance.

Infrastructure and Depot Costs

Bus depots, train stations, maintenance facilities, and administrative offices require ongoing lease or ownership costs, utilities, and facility management.

Why ComfortDelGro’s Business Model Is Defensible

Regulatory Barriers to Entry

Transport operations require extensive licenses, safety certifications, and regulatory approvals. New entrants face years of applications and proving operational competency before winning contracts.

In Singapore, for example, bus operations require Public Transport Operator licenses that government carefully controls. UK rail franchises undergo rigorous competitive tender processes favoring established operators.

Capital Requirements

Starting a competing bus or rail operation requires hundreds of millions in upfront investment:

- Fleet acquisition costs

- Depot and infrastructure development

- Working capital for operations

- Technology and systems implementation

Few companies possess both the capital and appetite for such asset-heavy businesses.

Government Relationships and Trust

Transport authorities award contracts based on proven track records. ComfortDelGro’s decades of reliable service create trust that newcomers cannot easily replicate.

Contract renewals favor incumbent operators who have demonstrated consistent performance.

Operational Scale Advantages

ComfortDelGro’s size creates efficiencies smaller operators cannot match:

- Better negotiating power with vehicle manufacturers

- Centralized maintenance reducing per-unit costs

- Shared technology platforms across operations

- Knowledge transfer between markets

ComfortDelGro vs Uber and Grab: Different Business Models

| Factor | ComfortDelGro | Ride-Hailing Platforms |

|---|---|---|

| Asset Ownership | Owns vehicles and infrastructure | Asset-light, drivers own vehicles |

| Regulation | Heavily regulated | Lighter regulation (increasing) |

| Revenue Stability | Predictable from contracts | Volatile, demand-dependent |

| Profit Model | Thin margins, high volume | Subsidized growth, future profitability |

| Growth Strategy | Steady expansion | Rapid market share capture |

| Capital Needs | Very high upfront | Lower initial, high marketing spend |

ComfortDelGro prioritizes stability and survival. Ride-hailing platforms bet on network effects and market dominance. Neither model is inherently superior—they optimize for different outcomes.

How ComfortDelGro Adapts to Technology and Sustainability

Digital Transformation Initiatives

ComfortDelGro has invested in technology while maintaining operational focus:

- Mobile booking apps for taxis across all markets

- Cashless payment systems integrated with local digital wallets

- Real-time bus arrival information through data platforms

- Fleet management software optimizing vehicle utilization

- Predictive maintenance using vehicle telematics

The approach is conservative but permanent. Technology gets deployed after thorough testing, not rushed to market.

Electric Vehicle Transition

ComfortDelGro is gradually electrifying its fleet:

- Over 1,000 electric and hybrid buses in operation

- EV taxi trials in Singapore and UK

- Charging infrastructure investment at depots

- Partnerships with energy providers for renewable electricity

The transition happens methodically, starting with routes where infrastructure supports EV operations and economics make financial sense.

Data-Driven Operations

ComfortDelGro uses data analytics for:

- Route optimization based on passenger demand patterns

- Driver performance monitoring and coaching

- Maintenance scheduling to prevent breakdowns

- Revenue management and pricing optimization

Major Risks Facing ComfortDelGro’s Business Model

Rising Labor Costs

Driver shortages in developed markets push wages higher, compressing already thin margins. Automation offers partial solutions, but autonomous vehicles remain years from widespread commercial deployment.

Regulatory and Policy Changes

Government transport policies shift over time. Authorities might:

- Bring operations in-house rather than contracting

- Change contract terms reducing profitability

- Implement costly new safety or environmental regulations

- Reduce public transport subsidies

Competition from Alternative Mobility

Private car ownership, ride-hailing apps, micro-mobility (e-scooters, bikes), and remote work all reduce public transport demand. ComfortDelGro must adapt to changing urban mobility preferences.

Fuel and Energy Price Volatility

Despite contract protections, sudden energy price spikes impact profitability, particularly in commercial taxi operations without full cost pass-through mechanisms.

Technology Disruption

Autonomous vehicles could eventually transform the industry, potentially reducing driver costs but requiring massive technology investment ComfortDelGro may struggle to match against well-funded tech companies.

What Business Leaders Can Learn from ComfortDelGro

Lesson 1: Diversification Reduces Existential Risk

ComfortDelGro spreads revenue across:

- Multiple business segments (buses, taxis, rail, maintenance)

- Multiple geographies (seven countries)

- Multiple customer types (government, individual passengers, corporate clients)

This structure ensures no single shock can destroy the business.

Lesson 2: Operational Excellence Creates Competitive Moats

In low-margin businesses, the most efficient operator wins. ComfortDelGro’s competitive advantage comes from:

- Superior fleet maintenance reducing downtime

- Optimized driver scheduling maximizing utilization

- Procurement expertise lowering input costs

- Decades of operational knowledge

Lesson 3: Government Partnerships Enable Stable Scaling

Working with governments brings constraints but also opportunities:

- Long-term revenue visibility from multi-year contracts

- Access to large-scale infrastructure projects

- Regulatory protection from aggressive competitors

- Legitimacy and trust in highly regulated sectors

Lesson 4: Boring Can Be Profitable

ComfortDelGro won’t make headlines for innovation, but it generates consistent returns in an essential industry. Not every business needs to disrupt—some succeed by executing fundamentals extremely well.

ComfortDelGro’s Geographic Expansion Strategy

Singapore: Home Market Dominance

Singapore represents approximately 65% of revenue. ComfortDelGro operates:

- Majority of public bus routes

- Significant taxi market share

- Downtown Line rail operations

- Leading vehicle inspection services

The home market provides cash flow funding international expansion.

United Kingdom: Largest International Market

UK operations contribute roughly 20% of revenue through:

- Bus operations in multiple cities

- Scottish rail franchise

- MetroCab taxi manufacturing and operations

Brexit and UK transport policy changes create ongoing uncertainty.

Australia: Strategic Presence

Australian operations include:

- Bus services in New South Wales and Victoria

- Vehicle inspection services

- Small but profitable market presence

China: High-Potential, High-Risk Market

China operations focus on:

- Taxi and ride-hailing services in several cities

- Bus operations in select regions

Chinese market offers growth potential but faces intense local competition and regulatory complexity.

Financial Performance and Investor Considerations

ComfortDelGro typically generates:

- Revenue: $3.5-4 billion SGD annually

- Operating margins: 8-12% depending on segment

- Return on equity: 6-9%

- Dividend yield: 4-5%

The stock appeals to income-focused investors seeking stable dividends rather than capital appreciation. Business model predictability supports consistent dividend payments.

The Future of ComfortDelGro’s Business Model

Opportunities Ahead

- EV transition creating demand for electric fleet expertise

- Aging populations in developed markets increasing public transport dependency

- Urbanization in developing markets expanding addressable market

- MaaS (Mobility as a Service) platforms integrating multiple transport modes

- Autonomous vehicle pilots potentially reducing long-term labor costs

Strategic Priorities

ComfortDelGro focuses on:

- Defending and growing government contract renewals

- Gradual fleet electrification

- Digital platform development

- Selective international expansion

- Efficiency improvements to protect margins

Final Verdict: Why This Traditional Model Still Works

ComfortDelGro proves that asset-heavy, regulated, low-margin businesses can create substantial value through operational excellence and strategic focus.

The company won’t achieve viral growth or unicorn valuations. But it will continue moving millions of people daily, generating steady cash flow, and maintaining essential infrastructure cities depend on.

In an era obsessed with disruption, ComfortDelGro’s business model demonstrates the enduring power of:

- Essential services people need regardless of economic cycles

- Long-term government partnerships providing revenue stability

- Geographic and segment diversification spreading risk

- Operational expertise developed over decades

For investors seeking stability, customers needing reliable transport, and governments wanting proven partners, ComfortDelGro’s traditional business model remains remarkably relevant in 2026.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.