ByteDance is a Chinese technology company that builds AI-powered content platforms, most notably TikTok and Douyin. Its business model centers on using sophisticated recommendation algorithms to capture user attention at scale, then monetizing that attention primarily through advertising, with growing revenue from live streaming gifts, e-commerce commissions, and enterprise software subscriptions. Unlike traditional social media companies that rely on social graphs (who you follow), ByteDance’s interest graph (what you enjoy) delivers hyper-personalized content feeds that generate exceptional engagement, making it one of the world’s most valuable private companies despite being founded only in 2012.

What Is ByteDance?

ByteDance was founded in 2012 by Zhang Yiming in Beijing with a clear vision: use machine learning to revolutionize content distribution. While competitors built social networks around friend connections, Zhang believed algorithms could deliver better content experiences by analyzing user behavior rather than social relationships.

The company’s key products span multiple categories: TikTok (international short video platform), Douyin (TikTok’s Chinese counterpart with more mature e-commerce features), CapCut (video editing app), Toutiao (AI-powered news aggregator that was ByteDance’s first hit product), Lark (enterprise collaboration platform competing with Slack and Microsoft Teams), and dozens of experimental apps in various markets.

ByteDance’s global vs China-first strategy is unusual—it simultaneously pursues domestic Chinese dominance and international expansion. TikTok and Douyin are technically separate apps with different content libraries, reflecting both regulatory requirements and strategic choices about how to serve distinct markets.

Why ByteDance is considered an AI company: At its core, ByteDance is a machine learning company that happens to build consumer apps. The recommendation algorithm is the company’s fundamental competitive advantage, applied across every product. While Meta or YouTube added algorithmic feeds to existing products, ByteDance built products specifically designed around algorithmic content delivery from day one. The company employs thousands of AI researchers and engineers, treating content recommendation as a technical problem requiring constant innovation, not just a feature of social platforms.

How ByteDance Works

The basic cycle is elegantly simple but tremendously powerful: Content creation → AI distribution → engagement feedback.

Creators upload videos, articles, or livestreams to ByteDance platforms. They need no existing follower base the algorithm will test their content with small audiences regardless of the creator’s previous success or follower count.

The algorithm analyzes each piece of content (visual elements, captions, sounds, topics) and user behaviors (watch time, likes, shares, comments), then distributes content to users most likely to engage with it. Unlike social media where content spreads primarily to followers, ByteDance’s system can make any video go viral by continuously showing it to larger audiences as long as engagement metrics stay strong.

Users consume endless personalized content feeds. Every interaction watching a video to completion, scrolling past quickly, liking, sharing, or lingering trains the algorithm to better predict what that specific user wants to see next.

Advertisers buy placement within these feeds, targeting users based on interests, behaviors, demographics, and even content consumption patterns. Because the platform knows what holds each user’s attention, ads can be targeted with exceptional precision.

This creates a flywheel: more creators mean more content variety, which means better personalization, which increases user engagement, which attracts more advertisers and creator monetization opportunities, which incentivizes more content creation.

ByteDance Business Model at a Glance

ByteDance operates an attention-based platform model it’s in the business of capturing human attention and selling access to that attention to advertisers. The more time users spend on ByteDance platforms, and the more precisely the company understands what holds each user’s attention, the more valuable that attention becomes.

AI-driven content discovery is the technological foundation. Unlike traditional media that requires editorial curation or social media that depends on social connections, ByteDance platforms use machine learning to match content with audiences algorithmically. This allows for infinite scale the system improves as it grows rather than becoming unwieldy.

The multi-product ecosystem spreads risk and compounds data advantages. User behavior insights from TikTok inform Douyin’s algorithm; video editing preferences from CapCut help TikTok understand content trends; news reading patterns in Toutiao reveal interest areas applicable across platforms.

Global scale, local monetization means ByteDance builds products that work worldwide but optimizes revenue generation for each market’s unique characteristics. In-app gifting dominates Chinese revenue while advertising leads internationally; e-commerce integration is far more aggressive in Asia than Western markets.

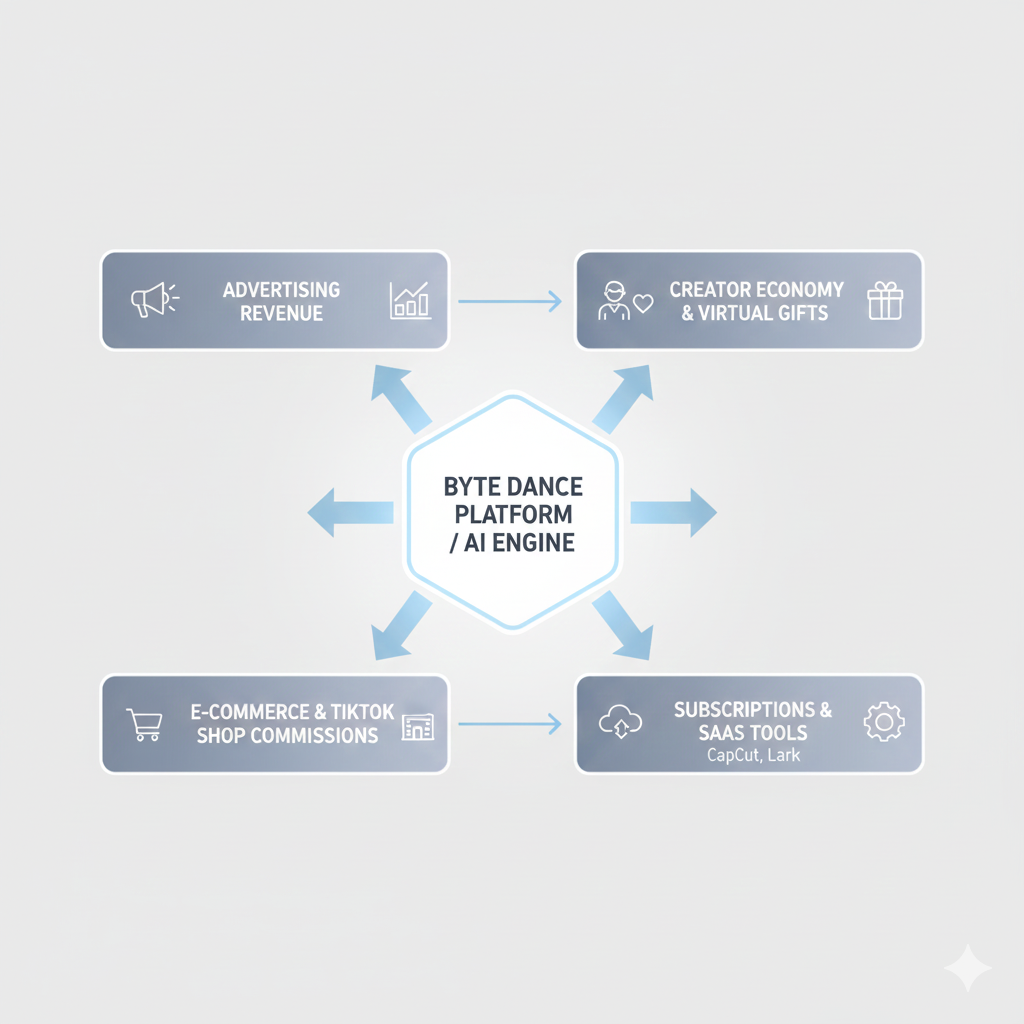

How ByteDance Makes Money (Revenue Model)

Advertising Revenue (Primary)

In-feed ads and video ads constitute the majority of ByteDance’s revenue globally. These ads appear seamlessly within content feeds, designed to look like organic content so users engage with them rather than scrolling past immediately. The format is native advertising perfected—promotional content that doesn’t feel disruptive.

Performance-driven ad targeting leverages ByteDance’s algorithmic advantage. Advertisers can target users based on incredibly specific interest signals: people who watch cooking videos to completion, users who engage with fitness content in the morning, shoppers who browse fashion but rarely purchase. This precision drives better campaign results than demographic targeting alone.

Why advertisers prefer ByteDance platforms: The engagement rates are exceptional. TikTok users spend an average of 52 minutes per day on the platform—time they’re actively engaged, not passively scrolling. High engagement means ads get seen and remembered. Additionally, ByteDance’s ad platform provides robust performance analytics, allowing advertisers to optimize campaigns in real-time based on actual user actions, not just impressions.

Creator Economy & Virtual Goods

Live streaming gifts represent a massive revenue stream, particularly in China where Douyin users send virtual gifts to creators during live broadcasts. These gifts cost real money (purchased with in-app currency), and ByteDance takes a commission—typically 50% or more—before passing revenue to creators.

Revenue sharing with creators extends beyond live streaming to include video view bonuses, creator funds that pay based on video performance, and brand partnership facilitation where ByteDance connects creators with advertisers and takes a cut.

Micro-transactions at scale work because individual gifts might cost $0.50 to $50, but across hundreds of millions of users sending billions of gifts annually, this becomes a multi-billion dollar revenue stream. The psychology is powerful: viewers develop parasocial relationships with creators and express appreciation through monetary gifts.

E-Commerce & Social Commerce

In-app shopping transforms content consumption into purchasing opportunities. TikTok Shop and Douyin’s shopping features let users buy products without leaving the app. A makeup tutorial becomes a direct path to purchasing the featured products; a gadget review links immediately to checkout.

Affiliate-driven product discovery means creators earn commissions by featuring products in their content. ByteDance facilitates these partnerships, takes a transaction fee from merchants, and shares affiliate commissions with creators. The algorithm promotes content that drives sales, creating incentives for creators to integrate shopping naturally.

Commission-based earnings from these transactions are still a smaller revenue percentage than advertising in most markets, but they’re growing rapidly—especially in China where Douyin has become a major e-commerce platform rivaling traditional marketplaces like Taobao in certain categories.

Subscription & SaaS Products

Lark (called Feishu in China) represents ByteDance’s enterprise ambitions. This workplace collaboration platform competes directly with Slack, Microsoft Teams, and Google Workspace, charging subscription fees for premium features while using ByteDance’s algorithmic intelligence to surface relevant information and automate workflows.

CapCut premium features monetize video editing through subscriptions that unlock advanced effects, remove watermarks, and provide additional storage. With CapCut becoming the default editing tool for many TikTok creators, this subscription revenue compounds as the creator economy grows.

Business tools and APIs allow developers and companies to integrate ByteDance’s capabilities—video processing, content recommendation, even algorithmic feeds—into their own products, creating B2B revenue streams beyond consumer platforms.

Key Customer Segments

Everyday content consumers form the massive user base—over a billion people globally scrolling through TikTok and Douyin daily for entertainment, education, and discovery. These users don’t pay directly but provide the attention that advertisers purchase.

Creators and influencers range from teenagers posting dance videos to professional content studios producing multiple videos daily. They’re suppliers in ByteDance’s attention economy, incentivized by potential monetization, audience growth, and creative expression opportunities.

Advertisers and brands include everyone from local restaurants buying $100 in targeted ads to global corporations spending millions on influencer partnerships and branded campaigns. They’re purchasing access to highly engaged audiences with precision targeting capabilities.

Businesses using SaaS tools include companies adopting Lark for internal collaboration and developers integrating ByteDance APIs, representing a growing but still smaller customer segment compared to the consumer platform users.

Value Proposition of ByteDance

For Users

Highly personalized content means every feed is unique. Unlike following accounts where you see what they post regardless of your current mood, ByteDance’s algorithm adapts in real-time—show interest in cooking videos and you’ll see more; scroll past them and they disappear from your feed.

Infinite entertainment loop creates an experience where there’s always something interesting next. The algorithm optimizes for session length, constantly testing content to keep you engaged just one more minute, one more video.

Low effort, high engagement distinguishes ByteDance platforms from social media that requires maintaining follower relationships or creating content to participate. On TikTok, you can be a pure consumer and get exceptional value—no friends required, no social obligation, just pure algorithmic entertainment.

For Creators

Organic reach via algorithm means new creators can go viral with their first video. Unlike Instagram or YouTube where building an audience takes months or years of consistent content, TikTok’s algorithm gives every video a chance with fresh audiences. This meritocracy (albeit imperfect) attracts creators who struggle to gain traction on follower-based platforms.

Multiple monetization paths include advertising revenue share, live streaming gifts, brand partnerships, affiliate commissions, and even direct fan support features. Creators can earn money with much smaller audiences than platforms like YouTube require.

Faster audience growth happens because viral content reaches millions organically. Creators report building followings in months that would have taken years on other platforms, making ByteDance platforms attractive for anyone trying to build a personal brand or business.

For Advertisers

Performance-based results mean advertisers can optimize campaigns toward specific outcomes—app installations, website clicks, product purchases—rather than just buying impressions and hoping for results.

Advanced targeting leverages behavioral data that other platforms can’t match. ByteDance knows not just who users are (demographics) but what captures their attention (interests and behaviors), enabling advertising precision that drives better ROI.

Scalable reach provides access to over a billion engaged users globally, with particularly strong penetration among younger demographics that many brands struggle to reach through traditional media.

ByteDance’s AI & Algorithm Advantage

Recommendation engine fundamentals use collaborative filtering, natural language processing, computer vision, and reinforcement learning to predict which content will engage which users. The system analyzes thousands of signals—video completion rates, rewatch behavior, likes, shares, comment sentiment, even how quickly users scroll past content.

Interest graph vs social graph is ByteDance’s philosophical departure from Facebook and Instagram. Social graphs connect people based on relationships: you see content from people you follow. Interest graphs connect people to content based on preferences, regardless of source. This removes the cold-start problem (new users see great content immediately) and the follower dependency (creators without audiences can still reach millions).

Data feedback loops constantly improve the algorithm. Every second, millions of users generate behavioral signals that train the recommendation system. The more content ByteDance distributes, the more interaction data it collects, the smarter the algorithm becomes, the better content matches improve, which increases engagement, generating more training data. This flywheel creates a compounding advantage.

Why content spreads faster on TikTok: The algorithm batch-tests every video with small audiences (200-500 views initially), analyzes engagement metrics, then progressively shows it to larger audiences if performance remains strong. A video can go from 0 to 10 million views in hours if each audience cohort engages highly. On Instagram or YouTube, growth is constrained by follower counts and subscriber bases—you reach your audience, then growth requires shares or algorithmic promotion. On TikTok, every video gets algorithmic promotion from the start based purely on quality signals.

Product Ecosystem Strategy

Single algorithm, multiple apps means ByteDance’s core technology powers everything. The recommendation engine that drives TikTok also powers Douyin’s e-commerce, Toutiao’s news feeds, and even Lark’s information discovery. This creates technical leverage—improvements to the core algorithm benefit all products simultaneously.

Experiment-and-scale approach embraces failure. ByteDance launches dozens of products annually, most of which shut down within months. The company ruthlessly analyzes engagement metrics and kills underperforming products quickly while doubling down on winners. This contrasts with companies that slowly develop products for years before launch.

How new products are tested and killed fast: ByteDance sets clear engagement metrics (daily active users, time spent, retention rates) and deadlines. If a new app doesn’t hit growth targets within 3-6 months, it’s typically shut down. Resources immediately shift to more promising experiments. This creates a culture of rapid iteration and evidence-based decision making rather than attachment to ideas.

Marketing & Growth Strategy

Algorithm-led growth means ByteDance relies less on traditional marketing than competitors. The core product experience—highly engaging personalized content—drives organic growth through word of mouth and viral content that appears on other platforms, generating curiosity.

Creator-first incentives include monetary creator funds, education programs, equipment grants, and dedicated support teams. By making creators successful, ByteDance ensures content supply grows with user demand. Many platforms talk about supporting creators; ByteDance systematically invests billions in creator programs.

Localization by country goes deep—not just translating interfaces but hiring local content moderators who understand cultural context, signing regional music licensing deals, customizing content categories for local interests, and adapting monetization features to local payment preferences.

Strong mobile-first design recognizes that most users access ByteDance platforms on smartphones. Every feature is optimized for vertical video, thumb-based navigation, and quick interactions. This mobile-native design gives ByteDance advantages over platforms that adapted desktop experiences for mobile.

Competitive Advantage of ByteDance

Best-in-class recommendation system remains the fundamental moat. While competitors have improved their algorithms (YouTube Shorts, Instagram Reels), ByteDance maintains a lead through continuous investment, massive training data, and organizational focus on algorithmic excellence.

Creator supply dominance creates network effects. Because TikTok is where creators can grow audiences fastest, the best creators concentrate there. Because the best creators are there, users prefer the platform, which attracts more creators. Breaking this cycle is difficult for competitors.

High user engagement time means ByteDance captures more attention per user than competitors. TikTok users average 52+ minutes daily; Instagram users spend about 30 minutes. More attention time means more ad inventory and higher lifetime user value.

Fast execution culture allows ByteDance to respond to competitive threats and market opportunities quickly. When Instagram launched Reels, TikTok had already introduced multiple new features. When e-commerce opportunities emerged, ByteDance integrated shopping features rapidly. This execution speed, inherited from Chinese tech’s competitive intensity, gives ByteDance advantages over slower-moving Western tech companies.

Challenges & Risks in ByteDance Business Model

Regulatory and geopolitical risks pose existential threats. The U.S. government has repeatedly attempted to ban TikTok over data security concerns and Chinese ownership. India successfully banned ByteDance apps in 2020, eliminating a massive market overnight. These political risks are unique to ByteDance among major tech platforms and create uncertainty around long-term international operations.

Content moderation pressure intensifies as ByteDance scales. Governments demand removal of illegal content; advertisers want brand-safe environments; users report harmful content. Moderating millions of videos daily in dozens of languages while respecting local laws and cultural norms requires enormous resources and perfect moderation is impossible, creating ongoing reputational and legal risks.

Platform dependency on creators means if ByteDance alienates creators through poor monetization, algorithm changes that reduce reach, or competitors offering better terms, content supply could shift. YouTube, Instagram, and others actively recruit TikTok creators with better revenue shares and integrated shopping features.

Monetization vs user experience balance creates tension. More ads increase revenue but potentially reduce engagement; aggressive e-commerce integration might annoy users preferring pure entertainment. ByteDance must optimize this trade-off carefully to avoid killing the engagement that makes the platform valuable.

ByteDance vs Meta vs Google (Business Model Comparison)

Attention capture approach: ByteDance uses algorithmic content recommendation to maximize engagement time; Meta uses social connections plus increasing algorithmic content; Google captures attention through search intent and YouTube’s mix of subscriptions and recommendations. ByteDance’s pure algorithmic approach generates the highest engagement per user but lacks the “social layer” that Meta claims creates stronger user retention.

Ads vs commerce focus: All three monetize primarily through advertising, but ByteDance is pushing hardest into integrated commerce, particularly in China where Douyin challenges traditional e-commerce platforms. Meta experiments with shopping but keeps it secondary to social features. Google remains primarily advertising-focused with minimal commerce integration beyond Shopping ads.

Algorithm strength comparison: ByteDance’s recommendation algorithm is widely considered superior for content discovery. Google’s search algorithm remains unmatched for intent-based queries. Meta’s algorithm balances social connections with content recommendations but doesn’t match ByteDance’s engagement metrics, though Meta’s advertising targeting (built on years of user data) rivals ByteDance’s precision.

Platform lock-in differences: Meta benefits from network effects—your friends are on Facebook, so you stay. Google benefits from data lock-in—your email, calendar, documents create switching costs. ByteDance offers weaker lock-in; users can switch to competitors without losing friend networks or data. ByteDance’s retention depends purely on having the best content experience, which requires constant algorithmic innovation.

Is ByteDance Profitable?

Revenue scale overview: ByteDance reportedly generates over $80 billion in annual revenue (2023 estimates), with the majority from advertising and significant portions from live streaming gifts and e-commerce commissions. This makes it one of the highest-revenue private companies globally.

Ad margins and creator payouts: Advertising businesses typically achieve high margins—Google’s ad business operates at 30%+ operating margins. ByteDance likely achieves similar efficiency at scale, though exact figures remain private. Creator payouts reduce margins somewhat, but because many creators participate for audience growth rather than direct payment, ByteDance keeps a large share of monetization proceeds.

Long-term sustainability of the model: The business model appears sustainable if regulatory challenges don’t force asset sales or market exits. The attention economy isn’t shrinking; advertising budgets continue shifting to digital platforms with proven targeting capabilities; and ByteDance’s algorithm advantage shows no signs of disappearing. However, geopolitical risks, potential regulation limiting data collection, and increasing competition from well-funded rivals could impact profitability trajectories.

What Founders Can Learn From ByteDance

Build distribution before monetization: ByteDance focused relentlessly on user growth and engagement before aggressively monetizing. TikTok was years old before introducing robust advertising, prioritizing the product experience that would make future monetization valuable. Many startups monetize too early, constraining growth.

Use AI as a core, not a feature: ByteDance demonstrates the power of building a company around AI capabilities rather than adding AI to existing products. The algorithm isn’t a feature of TikTok—TikTok is an interface for the algorithm. Founders should consider how AI can be foundational to their business model, not just an enhancement.

Obsess over engagement loops: ByteDance measures everything in terms of user engagement—time spent, session frequency, retention curves. Every product decision optimizes these metrics. This focus creates products people genuinely want to use rather than products companies want to build.

Ship fast, kill faster: The willingness to launch products quickly, gather data, and shut down failures without emotional attachment enables rapid learning and resource efficiency. Many companies waste years on failing products because they’re too invested to quit. ByteDance’s experiment-and-scale culture deserves emulation.

Future of ByteDance Business Model

Expansion into e-commerce will likely accelerate, particularly as TikTok Shop rolls out globally. ByteDance sees the potential to not just advertise products but complete entire purchase journeys in-app, capturing transaction fees in addition to advertising revenue. This could evolve ByteDance from attention monetization to transaction monetization.

More SaaS and productivity tools through Lark and potential new products diversifies revenue beyond advertising and consumer platforms. Enterprise software offers subscription predictability and B2B relationships less vulnerable to consumer platform regulations.

AI-generated content represents both opportunity and threat. ByteDance could leverage generative AI to fill content gaps, personalize experiences further, or even create synthetic creators. However, if AI content floods platforms with low-effort spam, distinguishing quality becomes harder and user experience suffers.

Increasing regulation impact: Governments worldwide are scrutinizing social media platforms more intensely data privacy laws, content moderation requirements, child safety regulations, and antitrust concerns. ByteDance must navigate an increasingly complex regulatory landscape while maintaining the product experience and business model that drove success. The company’s Chinese ownership creates additional scrutiny in Western markets that domestic competitors don’t face.

Business Point of View

ByteDance built one of the most powerful internet businesses in history by recognizing that algorithms could distribute content better than social connections or editorial curation. The company’s core insight that an interest graph creates more engaging experiences than a social graph proved revolutionary, enabling products that capture attention more effectively than competitors built on decade-old social media paradigms.

The business model is elegantly simple: capture attention through superior content recommendations, then monetize that attention through advertising, virtual goods, and increasingly, e-commerce transactions. Execution complexity hides behind this simplicity building recommendation algorithms that work across cultures and languages, moderating content at scale, managing creator relationships, and navigating geopolitical challenges all require exceptional operational capabilities.

ByteDance’s model deserves study by founders building consumer internet businesses, media platforms, or any product where user engagement determines success. The company demonstrates how AI-first architecture creates defensible advantages, how attention can be monetized through multiple revenue streams, and how rapid experimentation cultures enable finding product-market fit faster than methodical development approaches.

This model works because ByteDance mastered the fundamental challenge of digital platforms: connecting the right content with the right audience at the right time, at global scale. As long as humans have limited attention and businesses want to reach audiences, this model remains powerful. Whether ByteDance can maintain its leadership position depends on execution, regulation, and competition but the algorithmic content distribution model the company pioneered will shape internet platforms for decades regardless of any single company’s fate.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.

Pingback: What Is the Biggest Competitive Advantage of ByteDance? - Business Model Hub