Short answer: HelloFresh makes money by selling subscription-based meal kits directly to customers, charging weekly or monthly fees based on meal plans and delivery frequency.

HelloFresh is a meal kit delivery service that ships pre-portioned ingredients and easy-to-follow recipes straight to your door. Since launching in 2011, it’s become the world’s largest meal kit company, transforming how millions of Americans cook at home.

The company became popular by solving a universal problem: the daily stress of deciding what to eat, shopping for ingredients, and dealing with food waste. For busy professionals, parents, and anyone tired of the grocery store grind, HelloFresh offered a convenient middle ground between takeout and traditional cooking.

Founders and business students study HelloFresh’s model because it perfectly demonstrates how subscription economics, direct-to-consumer distribution, and operational efficiency can create a billion-dollar business in a traditional industry. It’s a masterclass in building predictable revenue while maintaining customer flexibility.

What is HelloFresh?

HelloFresh was founded in 2011 in Berlin, Germany, by Dominik Richter, Thomas Griesel, and Jessica Nilsson. The company went public in 2017 and now operates across three continents, serving millions of customers weekly.

The problem HelloFresh solves: Most Americans struggle with meal planning, grocery shopping takes time, and buying ingredients for recipes often leads to waste. You buy a bunch of cilantro for one recipe and watch the rest rot in your fridge.

The core offering: HelloFresh delivers boxes containing pre-portioned fresh ingredients and chef-designed recipe cards. Everything you need arrives in one package—no more, no less. Customers simply follow the step-by-step instructions to create restaurant-quality meals at home in about 30 minutes.

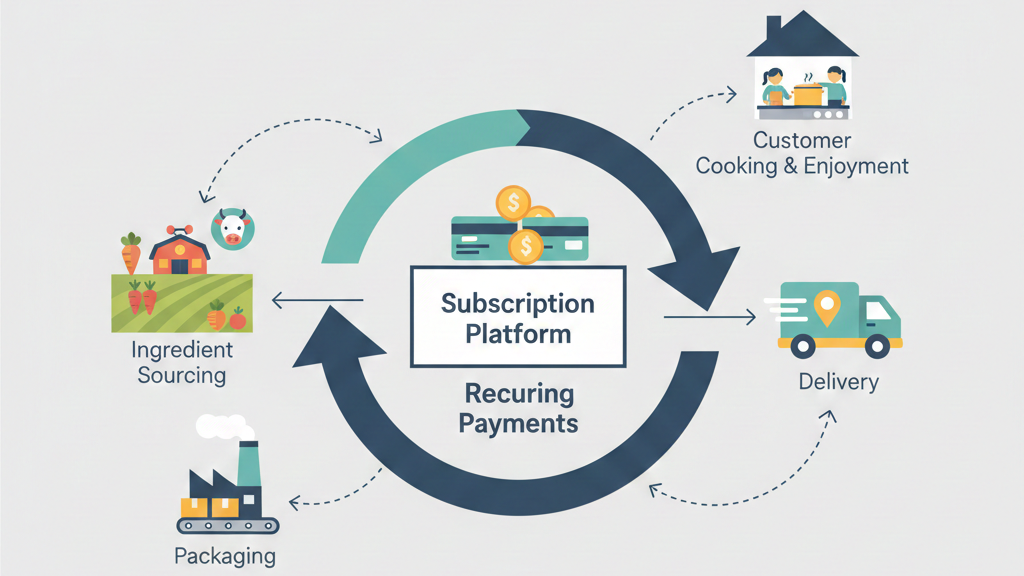

How HelloFresh Works (Simple Flow)

Here’s the customer journey from signup to dinner:

- User selects a meal plan – Choose from options like Meat & Veggies, Veggie, Family Friendly, Quick & Easy, or Pescatarian

- Weekly menu selection – Browse 30+ recipes each week and pick your favorites (typically 2-6 meals per week)

- Ingredients sourced & packed – HelloFresh purchases ingredients, portions them precisely, and packs them in insulated boxes with ice packs

- Delivered to customer’s door – Boxes arrive on a scheduled delivery day, no signature required

- Customer cooks meals – Follow the recipe card to prepare fresh, home-cooked meals

The entire process is designed to be frictionless. Customers can skip weeks, change preferences, or cancel anytime through the app or website.

HelloFresh Business Model Explained

1. Subscription-First Model

HelloFresh operates on a recurring subscription model that generates predictable revenue. Customers sign up for weekly deliveries, creating a steady cash flow that traditional restaurants and grocery stores can’t match.

The subscription includes flexible plans—you can choose 2, 3, 4, 5, or 6 meals per week for 2 or 4 people. This flexibility is crucial: customers don’t feel locked in. You can skip a week when you’re on vacation or cancel if your circumstances change. This “soft commitment” reduces the psychological barrier to signing up while still creating habitual ordering.

2. Direct-to-Consumer (D2C)

HelloFresh cuts out the middleman entirely. There are no supermarkets taking a cut, no distributors, no retail markup. The company controls the entire supply chain from farm partnerships to your doorstep.

This direct relationship means HelloFresh owns customer data, controls quality, and captures all the margin. They’re not competing for shelf space or dealing with grocery store slotting fees. The D2C model also enables rapid iteration based on customer feedback and purchasing patterns.

3. Personalization at Scale

HelloFresh uses data to personalize experiences while maintaining operational efficiency. They offer diet-based plans (vegetarian, pescatarian, low-calorie, family-friendly), regional menu variations based on local tastes, and data-driven recipe recommendations based on your past selections.

This personalization creates customer loyalty and increases retention. When HelloFresh knows you always skip beef recipes and love Thai flavors, they can curate a menu that feels tailor-made for you—even though they’re serving millions of customers with the same core recipes.

How HelloFresh Makes Money (Revenue Streams)

1. Meal Kit Subscriptions (Primary Revenue)

This is the bread and butter—over 95% of revenue comes from weekly meal kit subscriptions.

Pricing works on a per-serving basis, typically ranging from $7.99 to $12.99 per serving depending on your plan. Family plans (4 servings) have lower per-serving costs than 2-person plans. A typical customer might pay $60-$120 per week depending on how many meals they order.

2. Add-Ons & Upsells

HelloFresh has expanded beyond core meal kits to increase average order value. Customers can add desserts (like brownies or apple crumble), quick lunches, breakfast items, sides like garlic bread, and snacks or beverages to their weekly delivery.

These add-ons are high-margin products that require minimal additional logistics since they’re packed in the same box. A $5 dessert add-on might cost HelloFresh $1.50 to fulfill, creating attractive unit economics.

3. Premium Meal Pricing

Certain recipes command premium pricing. Gourmet recipes featuring steak, seafood, or specialty ingredients might cost $2-4 more per serving. Seasonal specials and limited-time chef collaborations also allow for premium pricing.

This tiered pricing strategy lets HelloFresh capture more value from customers willing to pay for variety while keeping base plans affordable.

4. Brand Partnerships (Limited)

While not a major revenue driver, HelloFresh occasionally partners with brands for co-branded ingredients or promotional campaigns. For example, using a specific brand of hot sauce in recipes or featuring name-brand products in meals.

These partnerships are selective to maintain quality perception, but they can provide incremental revenue or subsidized ingredient costs.

HelloFresh Pricing Strategy

HelloFresh’s pricing is designed around psychological principles and unit economics that improve with scale.

Per-meal pricing logic: By pricing per serving rather than per box, HelloFresh makes the cost feel smaller. “$9.99 per meal” sounds more approachable than “$119.88 per week,” even though they’re the same thing for a 6-meal plan.

Discounts for first-time users: New customers often get 50-70% off their first box, sometimes as low as $2-3 per serving. This dramatic discount overcomes acquisition resistance and gets people to try the service. HelloFresh knows that if they can get you to cook and enjoy three meals, retention rates spike.

Retention via pricing psychology: Regular customers see smaller rolling discounts (20% off week 3, 10% off week 5) that create a perceived loss if they cancel. The pricing also emphasizes the savings versus eating out—”Restaurant-quality meals for half the price of delivery.”

Why margins improve at scale: HelloFresh’s gross margins improve as they grow because they can negotiate better ingredient prices, optimize delivery routes, reduce packaging costs through bulk purchasing, and spread fixed technology costs across more customers. A customer in 2024 is more profitable than a customer was in 2015, even at similar prices.

Cost Structure of HelloFresh

Understanding where HelloFresh spends money reveals why scale matters so much.

Ingredient sourcing: The actual food represents 30-40% of revenue. HelloFresh negotiates directly with farms and suppliers, buying in massive quantities. A million meal kits per week means negotiating power that individual restaurants can’t match.

Packaging: Custom insulated boxes, ice packs, recipe cards, and portion packaging represent 10-15% of costs. These costs decrease per unit as volume increases.

Logistics & last-mile delivery: This is the biggest challenge, representing 25-35% of revenue. HelloFresh ships perishable goods on tight schedules to residential addresses. They’ve built regional fulfillment centers and partner with shipping companies for predictable routes, but last-mile delivery remains expensive.

Marketing & customer acquisition: HelloFresh spends aggressively to acquire customers—20-30% of revenue goes to marketing. This includes digital ads, influencer partnerships, referral bonuses, and those steep first-box discounts. The bet is that customer lifetime value exceeds acquisition costs.

Technology & data systems: The platform managing millions of weekly preferences, optimizing supply chains, predicting demand, and personalizing recommendations requires significant investment. This represents 5-10% of operating costs but creates competitive moats.

Key Metrics That Drive HelloFresh’s Business

Understanding HelloFresh means understanding the numbers that matter:

Customer acquisition cost (CAC): How much HelloFresh spends to get one new subscriber, typically $40-80. This includes all marketing spending divided by new customers acquired. The goal is to keep CAC below the customer’s first-year gross profit.

Average order value (AOV): The typical weekly order size, usually $60-90. HelloFresh constantly works to increase this through add-ons, premium meals, and encouraging customers to order more meals per week.

Retention rate: What percentage of customers continue subscribing month-over-month. High retention (70-80% monthly retention) is critical because the business model depends on customers staying for many months.

Churn: The flip side of retention—how many customers cancel each period. Annual churn in meal kits typically runs 60-80%, meaning constant new customer acquisition is necessary just to maintain subscriber counts.

Lifetime value (LTV): The total gross profit HelloFresh expects from a customer over their entire relationship. If the average customer stays 8 months and generates $15 gross profit per week, their LTV is roughly $480. The business works when LTV significantly exceeds CAC.

In simple terms: HelloFresh spends money to acquire you, loses money on your first discounted box, breaks even around week 4-6, and becomes profitable if you stick around for several months. The whole model depends on enough customers loving the service enough to keep subscribing.

HelloFresh’s Growth Strategy

1. Aggressive Marketing

HelloFresh has become synonymous with meal kits through relentless marketing. They pioneered influencer marketing in the food space, sending free boxes to YouTubers, bloggers, and Instagram personalities who’d share their cooking experiences.

Their referral program is genius: existing customers get credits for referring friends, and new customers get discounts. This creates a viral loop where happy customers become unpaid salespeople.

The first-box discount strategy (often 60-70% off) removes friction from trying the service. HelloFresh knows the product sells itself once people experience the convenience and quality.

2. Geographic Expansion

HelloFresh operates in the US, Canada, Australia, New Zealand, and several European markets. Each country gets localized menus reflecting regional tastes—more barbecue in Australia, maple-flavored options in Canada, regional German dishes in Europe.

Local sourcing where possible reduces costs and appeals to sustainability-minded customers. A customer in California might get produce from Central Valley farms, while a New York customer gets ingredients from regional suppliers.

3. Vertical Expansion

HelloFresh has expanded beyond traditional meal kits to capture more eating occasions. They launched Factor, a ready-to-eat meal service requiring zero prep—just heat and eat. This targets customers who want convenience but find even 30-minute cooking too time-consuming.

They’ve also added breakfast items, quick lunches, and snack options to increase the percentage of a customer’s food spending they capture. The goal is to become the primary food source for subscribers, not just a dinner solution.

Why HelloFresh’s Business Model Works

Predictable revenue: Subscriptions create reliable cash flow. HelloFresh knows with high accuracy how many meals they’ll deliver next week, next month, next quarter. This predictability allows for efficient inventory management and staffing.

Strong customer habits: Cooking HelloFresh meals becomes a routine. Tuesday and Thursday become “HelloFresh nights.” These habits create switching costs stopping means going back to the hassle of meal planning and grocery shopping.

Operational efficiency at scale: The model gets more profitable as it grows. Ingredient costs drop, delivery routes optimize, packaging gets cheaper, and fixed costs spread across more orders. A customer in a dense urban area with many other subscribers gets served much more profitably than an isolated rural customer.

Data-driven decisions: HelloFresh knows exactly which recipes perform well, which ingredients customers avoid, what pricing drives retention, and which marketing channels deliver profitable customers. This data compounds over time into a significant competitive advantage.

Challenges & Risks in HelloFresh’s Business Model

High logistics costs: Delivering perishable goods to residential addresses is expensive. Unlike Amazon, HelloFresh can’t leverage existing delivery infrastructure. Every route must be planned around delivery windows for freshness. Fuel costs, labor costs, and last-mile challenges directly impact margins.

Customer churn: Many customers view meal kits as a temporary solution or special occasion purchase. Life changes—people move, get busier, or simply get tired of the format. Churn rates of 60-80% annually mean HelloFresh must constantly acquire new customers just to maintain revenue.

Price sensitivity: When groceries are expensive, meal kits feel like a luxury. During economic downturns or inflation, subscription services are often the first thing people cut. HelloFresh must constantly prove value against cooking from scratch or cheaper alternatives.

Competition from multiple directions: Traditional grocery stores now offer meal kits, local farms offer CSA boxes, ghost kitchens deliver prepared meals, and companies like Amazon entered meal kit delivery. The competitive landscape is crowded and intensifying.

HelloFresh vs Traditional Grocery Model

| Factor | HelloFresh | Grocery Stores |

|---|---|---|

| Revenue | Subscription-based, recurring | One-time sales, unpredictable |

| Inventory | Predictive, demand-driven | Uncertain, waste-prone |

| Customer Data | Detailed preferences, behavior tracking | Limited loyalty card data |

| Margins | Scale-dependent, improve with growth | Thin (1-3%), relatively stable |

| Customer Relationship | Direct, owned | Indirect, transactional |

| Supply Chain | Vertical integration, controlled | Multiple distributors, complex |

| Personalization | High, data-driven | Low, mass market |

The fundamental difference is that HelloFresh knows exactly who’s buying what, when, and why. Grocery stores sell to anonymous customers and manage inventory based on historical trends. This data advantage allows HelloFresh to minimize waste, optimize sourcing, and create personalized experiences at scale.

Business Model Canvas – HelloFresh

| Component | Details |

|---|---|

| Key Partners | • Farms and ingredient suppliers • Shipping and logistics companies • Packaging manufacturers • Recipe development chefs • Technology infrastructure providers |

| Key Activities | • Menu planning and recipe development • Ingredient sourcing and quality control • Fulfillment center operations • Logistics and delivery management • Customer acquisition marketing • Platform and app development |

| Value Propositions | • Convenient meal planning solution • Fresh, pre-portioned ingredients • Reduces food waste • Flexible subscription (skip/cancel anytime) • Restaurant-quality recipes at home • Saves time vs grocery shopping |

| Customer Relationships | • Automated subscription management • Digital platform for meal selection • Customer service for issues • Email marketing and engagement • Loyalty through habit formation |

| Customer Segments | • Busy professionals (25-45 years old) • Young families seeking convenience • Health-conscious consumers • Cooking enthusiasts wanting variety • Urban and suburban households • Middle to upper-middle income |

| Channels | • Direct website and mobile app • Email marketing • Social media advertising • Influencer partnerships • Referral programs • Podcast and YouTube sponsorships |

| Revenue Streams | • Weekly meal kit subscriptions (primary) • Add-on products (desserts, snacks, drinks) • Premium meal pricing • Brand partnerships and co-promotions |

| Cost Structure | • Ingredient procurement (30-40%) • Packaging materials (10-15%) • Logistics and delivery (25-35%) • Marketing and customer acquisition (20-30%) • Technology and platform development (5-10%) • Labor (fulfillment centers, corporate) |

Can You Build a Business Like HelloFresh Today?

Is the market saturated? In the broad meal kit space, yes. HelloFresh, Blue Apron, Home Chef (owned by Kroger), and dozens of others compete aggressively. Breaking into the general market would require enormous capital for customer acquisition and fulfillment infrastructure.

What can founders copy?

- The subscription model creating predictable revenue

- Direct-to-consumer distribution owning customer relationships

- Using data to personalize at scale

- The focus on solving a specific customer pain point (meal planning hassle)

- Aggressive early-stage marketing to build brand awareness

What should be avoided?

- Competing head-to-head with established players in their core market

- Underestimating customer acquisition costs—they’re higher than you think

- Assuming customers will stay forever—plan for high churn

- Ignoring unit economics in pursuit of growth

- Skimping on logistics—delivery quality makes or breaks the experience

Micro-niche opportunities: The real opportunity isn’t replicating HelloFresh, but serving specific underserved niches:

- Medical condition-specific meal kits: Meals designed for diabetics, kidney disease patients, or cancer patients following specific nutritional protocols. These customers have clear needs that general services don’t address well.

- Hyper-local, farm-to-table kits: Partner with local farms within a 50-mile radius to deliver ultra-fresh, seasonal meal kits. Market on sustainability and supporting local agriculture. This works in foodie cities willing to pay premium prices.

- Cultural cuisine specialists: Instead of offering 30 different recipes weekly, become the best at one cuisine. Authentic Indian meal kits with hard-to-find spices, regional Chinese cooking, or traditional Mexican meals beyond the Americanized versions.

- Skill-building meal kits: Target aspiring chefs who want to learn techniques. Include video tutorials, technique cards, and progressively challenging recipes. Position it as cooking education, not just convenience.

- Singles and small households: Most meal kits assume 2-4 people. Create a premium service for people living alone who still want variety without massive food waste.

The key is finding a specific customer segment with a clear need that existing players don’t serve well, then building deep expertise and community in that niche. You won’t achieve HelloFresh’s scale, but you can build a profitable business serving customers who feel overlooked by mass-market solutions.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.