Getir is one of the companies that changed how people think about grocery delivery. Before Getir, online grocery meant waiting hours or even days. Getir made a bold promise: everyday essentials delivered to your door in minutes, not hours.

That single promise reshaped an entire category now known as quick commerce, or q-commerce.

Getir didn’t just build another delivery app. It built a tightly controlled logistics machine designed for speed, frequency, and convenience. At its peak, the company processed billions in transaction value and expanded rapidly across Europe and the US, becoming a reference point for both startups and investors studying last-mile delivery.

This article explains how Getir’s business model actually works behind the scenes. It is written for founders trying to understand operational businesses, investors evaluating unit economics, and operators curious about why ultra-fast delivery is both powerful and dangerous as a model.

More importantly, understanding Getir helps explain the future of urban logistics, consumer expectations, and why delivery speed alone is not enough to build a sustainable business.

What Is Getir? Company Background and Market Position

Getir was founded in Turkey and quickly expanded into multiple international markets across Europe and the United States. Unlike traditional grocery platforms that partner with existing stores, Getir built its own infrastructure from day one.

The company entered the market early, giving it a strong first-mover advantage in quick commerce. At a time when food delivery apps focused on restaurants, Getir focused on daily essentials like milk, snacks, household items, and personal care products.

Its core promise was simple and extremely clear: fast delivery, high convenience, and no planning required.

Getir’s main customers are urban consumers who value time over price. These are typically young professionals, students, and high-frequency buyers living in dense cities. The model works best when people place small but frequent orders instead of weekly bulk purchases.

This positioning allowed Getir to build strong brand recall. In many cities, “Getir” became almost synonymous with instant grocery delivery.

How Getir’s Business Model Works

At its core, Getir is not a marketplace. It is an operator. This distinction is critical to understanding both its strengths and weaknesses.

Dark Stores and Micro-Fulfillment

Getir operates through dark stores, which are small warehouses located inside cities. These are not open to customers. They exist only to fulfill online orders as fast as possible.

Instead of listing products from third-party sellers, Getir owns its inventory. It decides what products to stock, how much to stock, and where to place them. This gives Getir complete control over availability, pricing, and delivery speed.

The advantage is speed. Products are already nearby, packed and dispatched within minutes.

The downside is cost. Inventory ownership means capital is locked into stock. Dark stores require rent, staff, utilities, and operational management even when order volumes fluctuate.

This is why Getir’s model scales well only in dense urban areas. Without enough orders per dark store, fixed costs quickly eat into margins.

Last-Mile Delivery Operations

Delivery is handled by Getir’s own courier network in many markets. This gives the company more control over service quality and delivery times compared to relying fully on gig platforms.

Ultra-fast delivery is expensive by nature. Riders, vehicles, fuel, insurance, and idle time all add to costs. Delivering a small basket in ten minutes costs almost the same as delivering a large one.

To manage this, Getir relies heavily on technology. Routing algorithms, real-time order batching, and demand forecasting help reduce idle time and increase efficiency. Still, last-mile delivery remains the most challenging part of the model.

Speed delights customers, but it punishes unit economics if volume density is not high enough.

Getir’s Revenue Model: Where the Money Comes From

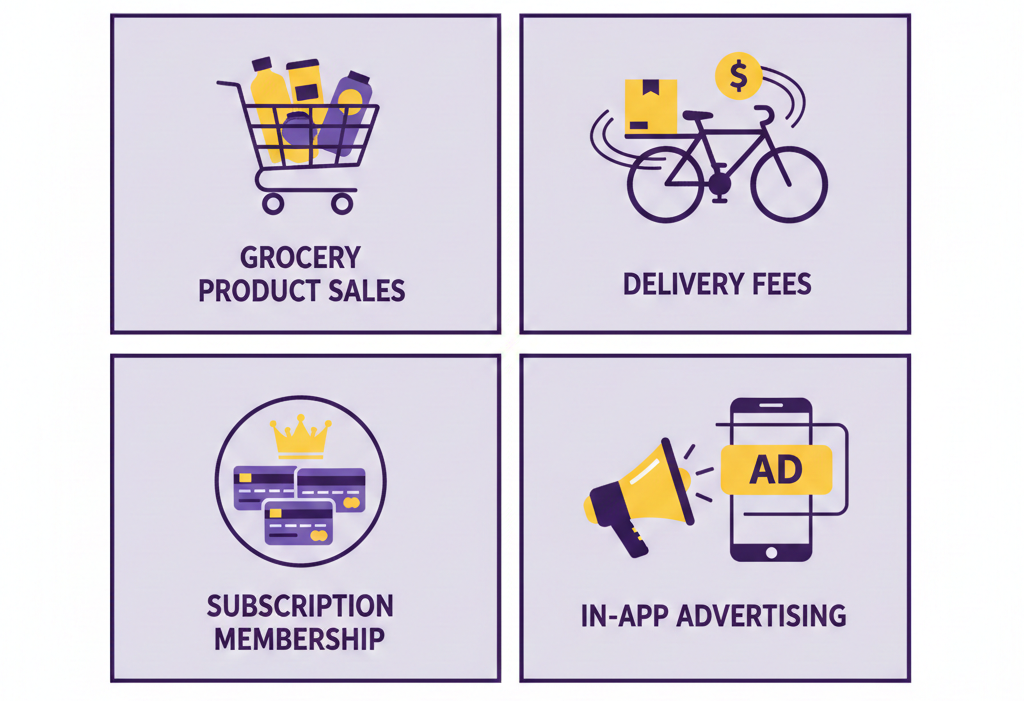

Getir does not rely on a single revenue stream. Its business model is layered, with some streams focused on growth and others on margin improvement.

Product Sales as the Primary Revenue Stream

The main source of revenue comes from selling groceries and everyday essentials directly to customers. Unlike marketplaces, Getir earns the full retail margin on these products.

Margins are higher on private-label items and exclusive products, which Getir can price strategically. These products also help differentiate the app from competitors offering the same branded goods.

Customer behavior is built around frequency. The average order value is relatively low, but repeat purchases are high. This is essential because profitability depends more on lifetime value than on single transactions.

Delivery Fees

Getir charges delivery fees that can be flat or dynamic depending on location and demand. In many cases, fees are kept low or waived entirely to encourage usage.

This creates a constant trade-off. Lower fees accelerate customer growth but reduce per-order contribution margins. Higher fees improve unit economics but risk slowing demand.

Most quick commerce players, including Getir, initially prioritized growth over profitability. Over time, delivery pricing becomes a lever to stabilize margins rather than a growth driver.

Getir Subscription Model

Getir introduced subscription plans that offer free or discounted delivery for a monthly fee. These plans create predictable recurring revenue and significantly increase customer lifetime value.

Subscribers tend to order more frequently and are less sensitive to delivery fees. This stabilizes demand and improves order density around dark stores.

However, subscriptions only work if customers use the service frequently enough. Otherwise, the economics shift back in favor of the customer, not the platform.

Advertising and Brand Partnerships

Advertising is an emerging and high-margin revenue stream. Brands pay for sponsored placements inside the app, preferred shelf positioning in dark stores, and visibility on packaging.

Because Getir controls both the digital and physical shelf, it offers brands something traditional ecommerce platforms cannot: end-to-end influence over purchase decisions.

This revenue stream has strong potential because it does not require additional delivery costs. As the user base stabilizes, advertising becomes one of the most attractive margin levers.

Getir Revenue Performance: What the Numbers Tell Us

At its peak, Getir reported multi-billion-dollar annual gross transaction volumes, driven by aggressive international expansion. Growth was rapid, but profitability lagged behind.

This was not unique to Getir. The entire quick commerce industry followed a similar pattern. Massive capital was invested into logistics infrastructure, dark stores, and customer acquisition.

When market conditions tightened, the industry faced a correction. Several players exited markets, merged, or shut down operations entirely. Getir also began pulling back from less profitable regions.

The key lesson is simple. Revenue alone does not equal success in quick commerce. Sustainable margins depend on order density, operational discipline, and cost control far more than headline growth.

Cost Structure and Unit Economics

Understanding Getir’s costs is essential to understanding its challenges.

Inventory holding costs are significant because products must be stocked close to customers. Unsold or expired inventory directly impacts margins.

Rider wages and delivery expenses form the largest variable cost. Ultra-fast delivery leaves little room for optimization unless volume is consistently high.

Dark store rent and operations are fixed costs that do not disappear during slow periods. Each store must generate enough orders to justify its existence.

Technology and platform development also require continuous investment. Routing systems, demand forecasting, and app experience are not optional in this business.

This is why order density matters more than almost any other metric. Cities with high population density, frequent users, and predictable demand perform far better than spread-out suburban areas.

Competitive Landscape and Differentiation

Getir operates in a crowded and competitive space. Competitors include other quick commerce startups like Gorillas and Flink, as well as traditional grocery chains offering delivery.

What initially set Getir apart was timing and execution. It moved early, built strong brand recall, and invested deeply in vertical integration.

Owning inventory, delivery, and customer experience allowed Getir to move fast and control quality. But it also made the business more capital-intensive than marketplace models.

As competition increased, differentiation shifted from speed alone to efficiency, product mix, and retention.

Risks, Challenges, and Criticisms

The biggest challenge in Getir’s model is thin margins. Grocery is a low-margin category by default, and ultra-fast delivery adds cost on top.

Labor regulations also pose risks, especially in markets where employment models are under scrutiny. Compliance increases costs and reduces flexibility.

The business is capital-intensive, requiring continuous investment in infrastructure and technology.

Consumer behavior is another variable. Post-pandemic, some users returned to offline shopping or reduced reliance on instant delivery.

These risks do not invalidate the model, but they demand discipline and realism.

The Future of Getir’s Business Model

Getir’s future depends on focus rather than expansion. The emphasis has shifted to core profitable markets where density and demand justify the model.

High-margin revenue streams like advertising and private-label products will play a bigger role.

Operational efficiency will matter more than speed bragging rights. Being fast is no longer enough. Being profitable is the real benchmark.

Getir may also play a role in industry consolidation, partnerships, or infrastructure sharing as the market matures.

Conclusion: Key Takeaways for Founders, Investors, and Operators

Getir proved that ultra-fast delivery demand is real. Consumers value convenience more than ever, especially in dense urban environments.

But the business model only works under specific conditions. Revenue growth must align with sustainable unit economics.

The model performs best when order frequency is high, cities are dense, and operations are tightly controlled.

For founders and investors, Getir is a reminder that logistics-heavy businesses reward discipline, not just ambition. Speed attracts users, but efficiency keeps the business alive.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.