Short Answer

Acme Corp operates on a diversified business model that combines product sales, recurring contracts, and enterprise partnerships to drive predictable revenue and long-term growth. The company balances transactional revenue with sticky subscription contracts, allowing it to capture both one-time buyers and long-term enterprise customers.

What Is Acme Corp? (Quick Overview)

Acme Corp has become the go-to example when business students, consultants, and entrepreneurs talk about diversified business models. While “Acme” is often used as a placeholder name in case studies and business literature, the framework represents a real archetype: companies that successfully blend product sales with service contracts to build resilient revenue engines.

The typical Acme Corp operates in B2B or hybrid markets—think industrial equipment, enterprise software, or specialized manufacturing. The core problem it solves is providing reliable, scalable solutions that customers can depend on for critical operations. Its customers range from small businesses looking for off-the-shelf products to Fortune 500 companies that need customized solutions and white-glove support.

Why does Acme Corp show up in every business strategy textbook? Because it demonstrates how a company can avoid over-reliance on any single revenue stream, customer segment, or market condition. It’s the blueprint for building a business that can weather economic downturns, pivot when necessary, and scale predictably.

Acme Corp’s Core Value Proposition

Acme Corp doesn’t win on price alone—it wins on reliability, trust, and comprehensive solutions.

What Acme Corp offers better than competitors:

- Proven track record: When enterprises need something that absolutely cannot fail, they go with Acme. The brand has decades of credibility.

- End-to-end solutions: Instead of forcing customers to piece together multiple vendors, Acme provides integrated packages that just work.

- Support infrastructure: 24/7 customer service, dedicated account teams for large clients, and deep technical expertise.

Key customer pain points it solves:

- Reducing operational risk through dependable products

- Simplifying procurement by bundling products and services

- Minimizing downtime with proactive maintenance and support

- Scaling without having to constantly switch vendors

Why customers choose Acme Corp over alternatives:

Startups might offer flashier features or lower prices, but when the stakes are high, customers choose the company they know won’t let them down. Acme’s positioning centers on being the “safe choice”—and in B2B, that’s often the winning choice. Companies would rather pay 20% more for Acme than risk a project failure with an unproven vendor.

Acme Corp Target Customers

Understanding who pays versus who uses the product is crucial for grasping Acme’s business model.

Individual / SMB customers: These are the transactional buyers. They purchase off-the-shelf products online or through distributors. They’re price-sensitive, don’t need much hand-holding, and typically generate lower lifetime value. However, they provide volume and help Acme maintain manufacturing scale.

Enterprise customers: This is where the real money is. Large corporations sign multi-year contracts that include products, services, maintenance, and support. The sales cycle is longer (often 6-18 months), but the deals are worth it. These customers care more about reliability and ROI than upfront cost.

Government or institutional buyers: Municipalities, universities, and government agencies often have specific procurement requirements. Acme maintains certifications and compliance standards that make it easy for these buyers to justify their purchases. These deals can be massive but come with bureaucratic overhead.

Internal or B2B partners: Acme also sells to resellers, systems integrators, and OEM partners who embed Acme products into their own solutions. These partners pay wholesale prices but expand Acme’s reach without requiring direct sales investment.

Who pays vs who uses: In enterprise deals, procurement departments cut the checks, but end users (engineers, operations teams, etc.) are the ones who actually use the products daily. Acme has to satisfy both: the CFO cares about total cost of ownership, while the plant manager cares about whether it’ll break down during a critical production run.

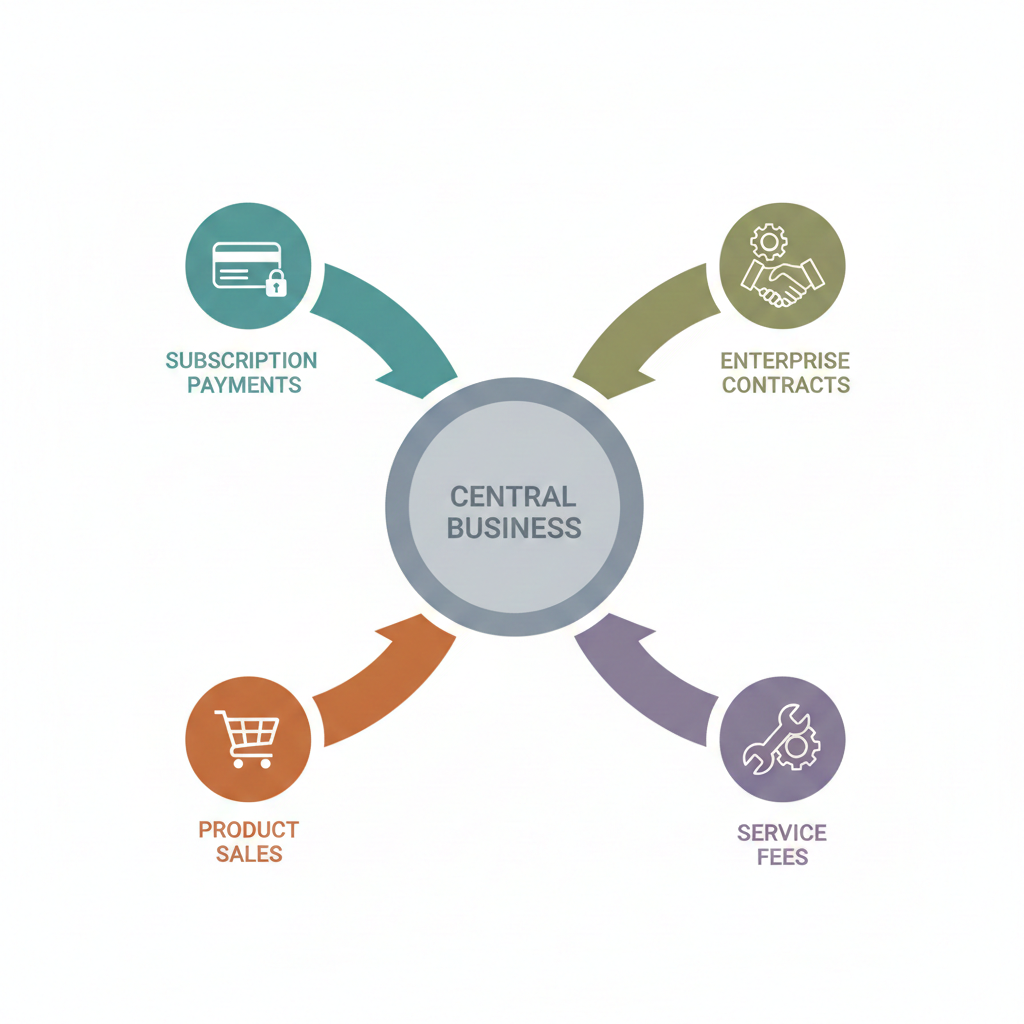

How Acme Corp Makes Money (Revenue Model)

Acme’s revenue model is beautifully diversified—no single stream dominates to the point of creating excessive risk.

Product sales: The foundation. Acme sells physical products or software licenses as one-time purchases. This generates immediate cash flow and often serves as the entry point for new customers. Margins vary depending on whether it’s a commodity product (lower margin, higher volume) or a specialized solution (higher margin, lower volume).

Subscription or recurring revenue: Once a customer buys a product, Acme offers subscription plans for software updates, premium features, or consumables. This creates predictable monthly or annual revenue and increases customer lifetime value. It’s also the stickiest revenue—once you’re paying $500/month for something critical to your operations, you’re not canceling it lightly.

Licensing or usage-based fees: For customers who need flexibility, Acme offers pay-as-you-go models. Manufacturing clients might pay per unit produced, or software customers might pay per transaction processed. This aligns Acme’s revenue with customer success, making it easier to justify the expense.

Enterprise contracts: Large customers sign multi-year agreements that bundle products, services, training, and support into one package. These contracts often include minimum commitments, giving Acme revenue visibility years in advance. They also create high switching costs—ripping out an Acme system after two years of integration is painful and expensive.

Services, maintenance, or support fees: Even after the initial sale, customers pay for installation, training, ongoing maintenance, and emergency support. Service revenue often carries higher margins than product sales because it’s labor-based and harder for competitors to commoditize. For many industrial companies, service revenue eventually exceeds product revenue.

Which revenue stream is the biggest? For mature versions of Acme Corp, enterprise contracts and recurring revenue typically represent 60-70% of total revenue. Product sales might drive 20-30%, with services making up the remainder.

Which one is the most scalable? Recurring subscription revenue is the most scalable because it compounds. Each new customer adds to the base, and as long as churn stays low, the revenue builds year after year without proportional increases in sales costs.

Acme Corp Business Model Canvas

Key Partners

Suppliers: Acme relies on a network of component manufacturers, raw material suppliers, and logistics providers. For critical components, Acme often maintains relationships with multiple suppliers to avoid single points of failure.

Technology partners: Software integrations, cloud infrastructure providers, and R&D collaborators help Acme stay innovative without building everything in-house. Strategic partnerships with companies like AWS, Microsoft, or industry-specific platforms extend Acme’s capabilities.

Distribution or logistics partners: Global distributors, regional resellers, and third-party logistics providers help Acme reach customers it couldn’t serve cost-effectively on its own. These partners handle local inventory, last-mile delivery, and regional customer service.

Key Activities

Product development: Continuous R&D keeps Acme ahead of competitors. This includes iterating on existing products, developing new offerings, and adapting solutions for emerging markets or regulations.

Manufacturing or service delivery: Whether Acme makes physical products or delivers software, operational excellence is critical. Lean manufacturing, quality control, and supply chain optimization ensure products ship on time and work as advertised.

Sales and marketing: Enterprise sales teams build relationships with large accounts, while digital marketing and inside sales handle SMB customers. Trade shows, content marketing, and case studies generate awareness and leads.

Customer support: Post-sale support is non-negotiable. Technical support teams, account managers, and training programs ensure customers extract maximum value from their purchases—which drives renewals and upsells.

Key Resources

Technology: Proprietary systems, patents, manufacturing processes, or software platforms create differentiation and defensibility. The harder these are to replicate, the stronger Acme’s moat.

Brand: Decades of reputation mean enterprise buyers trust Acme by default. Brand equity reduces sales friction and allows Acme to charge premium prices.

Talent: Engineers, sales professionals, and customer success teams are Acme’s competitive advantage. Top talent is expensive but essential for maintaining quality and innovation.

Data or IP: Customer usage data, design patents, and trade secrets give Acme insights competitors can’t match. This intellectual property can be the difference between leading the market and playing catch-up.

Value Propositions

(Recap from earlier section) Reliability, comprehensive solutions, proven track record, and support infrastructure that minimizes customer risk and maximizes uptime.

Customer Relationships

Self-serve: SMB customers browse online catalogs, place orders, and access help documentation without ever talking to a human. This keeps acquisition costs low.

Dedicated account management: Enterprise customers get assigned account executives who understand their business, anticipate needs, and coordinate across Acme’s organization to deliver custom solutions.

Long-term contracts: Multi-year agreements align incentives. Customers get price predictability and guaranteed support levels; Acme gets revenue visibility and reduced churn.

Channels

Direct sales: Enterprise sales reps handle complex, high-value deals. They build relationships, navigate organizational politics, and close contracts worth millions.

Online platforms: Acme’s e-commerce site serves SMB customers who want to buy quickly without sales calls. This channel scales efficiently and captures customers who prefer self-service.

Resellers or distributors: Third-party partners extend Acme’s reach into niche markets, international regions, or customer segments that don’t justify direct sales investment.

Customer Segments

SMBs, enterprises, government/institutional buyers, and B2B partners each with distinct needs, buying processes, and profitability profiles.

Cost Structure

Fixed costs: R&D, corporate overhead, brand marketing, and manufacturing facilities require ongoing investment regardless of sales volume. These costs create barriers to entry but also pressure Acme to maintain scale.

Variable costs: Raw materials, component parts, sales commissions, and customer support scale with revenue. Managing variable costs efficiently is crucial for maintaining margins as the business grows.

Major expense drivers: Talent (especially engineering and sales), manufacturing or cloud infrastructure, customer acquisition costs, and logistics. In mature companies, customer acquisition costs often decline as brand reputation does more of the selling.

Revenue Streams

Product sales, subscriptions, usage-based fees, enterprise contracts, and service revenue—each contributing to a balanced, resilient top line.

Acme Corp Pricing Strategy

How pricing is structured: Acme uses tiered pricing to capture different customer segments. Entry-level products are priced competitively to attract new customers. Mid-tier offerings include more features and support. Premium enterprise solutions are priced based on value delivered, not just cost-plus margins.

One-time vs recurring pricing: Products can be purchased outright, but Acme pushes customers toward subscription models whenever possible. A $10,000 product might also be available for $300/month over three years—making it more palatable for budget-conscious buyers while generating higher lifetime revenue for Acme.

Enterprise vs consumer pricing differences: SMB customers see standard prices and buy online. Enterprise customers negotiate custom pricing based on volume, contract length, and bundled services. This flexibility helps Acme win large deals without devaluing its offerings for smaller customers.

How pricing supports long-term retention: Annual contracts often include discounts compared to monthly plans, incentivizing customers to commit longer. Renewal pricing rewards loyalty—customers who stay for multiple years get better rates than new customers, reducing churn and increasing lifetime value.

Go-To-Market Strategy of Acme Corp

Sales-led vs product-led approach: Acme uses a hybrid model. Enterprise deals require traditional sales—relationship building, demos, pilots, and contract negotiations. SMB customers experience a more product-led approach—they can sign up online, try the product, and upgrade without ever talking to sales.

Marketing channels used: Content marketing (case studies, whitepapers, webinars) establishes thought leadership and generates inbound leads. Paid search and display ads capture high-intent buyers. Trade shows and industry events build relationships with enterprise prospects. Account-based marketing targets specific high-value companies with personalized campaigns.

Partnerships and enterprise sales motion: Acme cultivates relationships with consultants, systems integrators, and industry influencers who recommend solutions to their clients. These partnerships create credibility and shorten sales cycles. The enterprise sales process typically involves discovery calls, technical evaluations, pilot programs, executive buy-in, and legal negotiations—sometimes taking a year or more.

Expansion strategy (new markets, upsells): Acme follows a “land and expand” strategy. Start with a small deal to get a foot in the door, then prove value and gradually expand to other departments, use cases, or product lines. Geographic expansion happens strategically—enter new regions only when there’s sufficient demand to justify local support infrastructure.

Competitive Advantage of Acme Corp

Economies of scale: Acme’s size allows it to negotiate better supplier terms, invest more in R&D, and spread fixed costs across a larger revenue base. Smaller competitors can’t match Acme’s pricing while maintaining similar margins.

Brand trust: When a procurement manager gets fired, it’s rarely because they chose Acme. The brand represents safety and credibility. This trust is earned over decades and nearly impossible for startups to replicate quickly.

Switching costs: Once a customer integrates Acme’s products into their operations, switching becomes expensive and risky. Data migration, employee retraining, workflow disruption, and integration complexity all make customers think twice before leaving—even if a competitor offers a better product.

Technology or process advantage: Proprietary manufacturing techniques, patents, or specialized expertise create differentiation. Even if competitors understand what Acme does, they can’t easily replicate how it’s done.

Network effects (if any): In some versions of the Acme model, the product becomes more valuable as more users adopt it. For example, if Acme runs a platform or marketplace, more buyers attract more sellers and vice versa. However, traditional product-based Acme models often lack strong network effects.

Risks and Weaknesses in Acme Corp’s Business Model

Revenue concentration risks: If 40% of revenue comes from one industry or a handful of large customers, a downturn in that sector or losing a major account could devastate the business. Diversification helps, but it’s hard to achieve perfect balance.

Operational complexity: Serving both SMBs and enterprises with different products, pricing, and support models creates complexity. Systems that work for one segment might break for another. Managing this complexity is expensive and requires sophisticated operations.

Dependency on partners or suppliers: If a critical component supplier goes bankrupt or a key distribution partner switches to a competitor, Acme’s business could suffer. Supply chain disruptions (like we saw during COVID) expose these vulnerabilities.

Market or technology shifts: Acme’s competitive advantages are built on current market conditions. Disruptive technologies, changing regulations, or shifting customer preferences could undermine its position. Companies that dominated industries for decades have collapsed when they failed to adapt—think Kodak, Blockbuster, or Nokia.

How Acme Corp Scales Its Business

Expansion into new markets: Geographic expansion is the most obvious path—taking a successful model from the US to Europe, Asia, or Latin America. Vertical expansion also works: if Acme dominates manufacturing, it might move into adjacent sectors like healthcare or logistics using the same playbook.

Product line extensions: Once Acme owns a customer relationship, it can sell complementary products. A company that bought Acme’s core product might also need accessories, consumables, software, training, or maintenance—each representing incremental revenue without the cost of acquiring a new customer.

Automation and efficiency: As Acme grows, it invests in systems that reduce per-unit costs. Automated manufacturing, self-service customer portals, AI-powered support, and streamlined logistics all improve margins without requiring proportional headcount growth.

Enterprise and long-term contracts: Locking in large customers with multi-year agreements creates predictable revenue that funds further expansion. These contracts also provide case studies and references that make it easier to close the next deal.

What Startups Can Learn from Acme Corp

What to copy:

- Diversify revenue streams early. Don’t rely on a single product or business model. Even small companies can offer both one-time sales and recurring revenue.

- Build for retention, not just acquisition. A customer who stays for five years is worth far more than five one-year customers. Design your product and pricing to maximize lifetime value.

- Enterprise customers are worth the effort. Yes, the sales cycle is longer and the deals are complex, but landing one $500K annual contract beats closing 500 $1K deals.

- Invest in brand and trust. Especially in B2B, reputation matters more than flashy marketing. Case studies, customer success stories, and transparent communication build credibility.

What to avoid:

- Don’t over-complicate too early. Acme can manage complexity because it has the resources. Early-stage startups should focus on one customer segment and nail that before expanding.

- Don’t compete on price alone. Acme wins on reliability and value, not being the cheapest option. Racing to the bottom on price is a losing strategy for most startups.

- Don’t neglect post-sale experience. Many startups focus obsessively on closing deals but ignore onboarding, support, and retention. That’s how you end up with high churn and negative word-of-mouth.

What works only at scale:

- Complex channel partnerships. Managing distributors, resellers, and OEM partners requires significant infrastructure and legal resources.

- Heavy R&D investment. Acme can afford to invest millions in developing new products that might not pay off for years. Startups need faster feedback loops.

- Building proprietary manufacturing. Unless you’re a hardware company with serious funding, outsourcing production makes more sense than building your own facilities.

What works even for early-stage startups:

- Start with a land-and-expand strategy. Get a small win with a customer, prove value, then grow the account.

- Create switching costs early. Even simple integrations or workflows that embed your product into customers’ operations increase retention.

- Build relationships, not just transactions. Whether you have 10 customers or 10,000, treating customers as long-term partners creates loyalty and advocacy.

Wrapping Up

The Acme Corp business model isn’t flashy, but it works. By diversifying revenue streams, balancing transactional and recurring income, and building genuine competitive advantages, companies following this playbook create resilient, scalable businesses.

What makes Acme compelling as a case study is its realism. It doesn’t rely on winner-take-all network effects or viral growth. Instead, it builds steadily through product excellence, customer trust, and operational discipline. Those are things any company can pursue, regardless of industry or stage.

Discover more from Business Model Hub

Subscribe to get the latest posts sent to your email.